2021 was a very interesting year for currencies.

Crypto gained serious market attention – BTC skyrocketing to over $65K and ETH jumping 272% from January 1 to December 1, 2021. Even so-called shitcoins (crypto with little or no value) like Dogecoin and Shiba Inu exploded this year.

But hands down, the craziest thing happening in the world of currencies is the endless money printing in the US.

Would you believe me if I told you that over 40% of the money in the US was printed in the last 12 months?1

I wish I was lying, but the fact is, the US Fed printed over $13 trillion dollars in the last year – that’s more than the country spent in its 13 most expensive wars combined!2

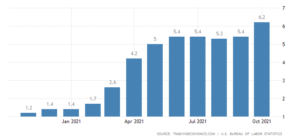

Meanwhile, inflation rose to an unbelievable 6.2% in October 2021, marking the largest rise in three decades.3

Meanwhile, inflation rose to an unbelievable 6.2% in October 2021, marking the largest rise in three decades.3

It’s no wonder that Gemini co-founder and billionaire investor Tyler Winklevoss is calling the US dollar “the ultimate shitcoin.”4

The fact is, your money is worth a lot less than it was a year ago. And the emergence of yet another CV-19 variant in the US5 could lead to more money printing, more inflation and even more need for safe haven investments to protect your wealth.

Some investors are looking at crypto as their saviour, but others see silver and gold as the best hedge against the impending market crash.

One example is Billionaire Investor Eric Sprott. He continues putting his money on precious metals and it’s clearly paying off.

One example is Billionaire Investor Eric Sprott. He continues putting his money on precious metals and it’s clearly paying off.

Sprott Inc.’s AUM increased by 88% in 2020 to a record high of $17.4 billion, mostly due to new inflows into the Sprott Physical Silver Trust,5 and has now surpassed $20 billion AUM.6

The silver market has had a rocky few months, but fundamentals point to a strong rebound on the horizon and now could be the perfect time to buy the dip.

And I think one of Sprott’s recent investments could be the perfect way to get in on silver before the market makes a comeback.

I’m talking about Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF), a junior mining and exploration company drilling two high-grade past-producing silver-gold properties in Nevada and New Mexico.

There are a ton of reasons I’m excited about this company, but I’ll start by sharing:

5 Reasons

Why Summa Silver is Such an Exciting Opportunity

1

Significant Investors: Not only does legendary investor Eric Sprott own 18% of the company, the leadership team has a ton of skin in the game, with 30% insider ownership

2

Shareholder Control: Tight share structure and inside ownership means that management and the legendary Eric Sprott have good control over operations, capital management, and future investment.

3

Two High-Grade Properties: The Hughes and Mogollon properties are located in high-grade past-producing properties in mining-friendly silver-gold districts. Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) is in just the right location.

4

Rapidly Advancing Work Programs: A 15,000m drill program is underway at Mogollon, and upcoming assay results from Hughes. The company also intends to file for a NI 43-101 compliant resource for both projects in Q4 2022.

5

Hot Sector: Silver mining stocks heating up fast – Canadian company SilverCrest Metals stock went from US$1.90 in March 2018 to US$9.12 on November 16, 2021; 380% higher!

Breakout at Any Moment?

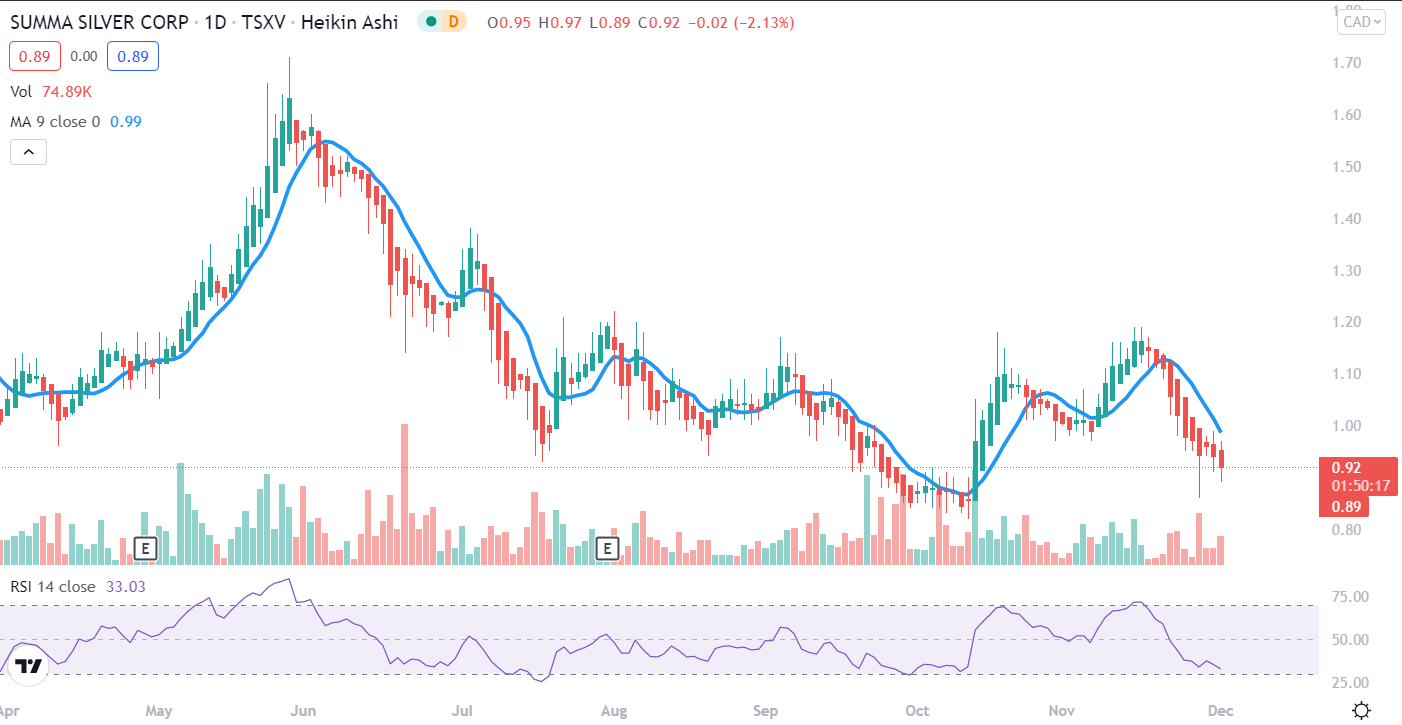

Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) trades at C$0.97, has 63.78m shares issued and a market cap of C$45.7 million on December 8, 2021. The stock has remained in a stable and rising range since its IPO, and has most importantly broken above its moving average several times since April 2021. Currently, the stock is ranging from C$0.80 to C$1.18, and could be ready for a breakout at any moment if it builds momentum above the moving average again.

Two Rapidly Advancing Properties in Top Mining Regions

Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) has been rapidly advancing both the Mogollon and Hughes properties.

Summa Silver has already seen significant results from the ongoing drill program at the Hughes Property, which hosts the Belmont Mine, one of the most prolific silver producers in the US from the 1920s.

In September, Summa announced that Rescue veins from the Belmont Mine intersected 1,699 g/t silver equivalent over 4.3 m including 9,989 g/t silver equiv. over 0.6 m.8

Summa (TSXV:SSVR) (OTCQB:SSVRF) has just wrapped up the 10,000 meter 2021 drill program at Hughes and expects assay results in Q4 2021 and Q1 2022. This could be huge news coming in the very near-term!9

The company also just began a 15,000m drill program10 at the 2,467-acre Mogollon Property in New Mexico and provided an update on property-wide geological, geophysical and remote sensing surveys.

And Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) isn’t slowing down in 2022, with plans for new resource-style drilling at Hughes and of course, a focus on new discoveries.

Oh and did I mention that Summa Silver is targeting a NI 43-101 compliant resource for these two high-grade properties next year as well?

You will want to dig even deeper about what this company has to offer.

Find out more about Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) now, before everyone else does, by clicking here.