The New Variant, Inflation & Other Factors Are Once Again Putting the Spotlight on Silver as a “Safe Haven” Investment…

Find Out Why Many Are Betting on Little-Known Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) to Seize This

Unique Opportunity & Break Out!

Here we go again?

Just when things were beginning to get back to “normal” a new CV-19 variant emerged and is quickly sweeping around the world. In fact, the CDC just recently confirmed the first US case had been detected in California.1

Last year this disease wreaked havoc upon the silver supply – causing mines to be shut down by government decree in top producing countries like Mexico.2

Kitco reported last year that shutdowns “had impacted silver mining production the most.3

So are more shutdowns in the cards for the coming year? If so, even more silver supply shortages combined with rampant inflation and other uncertain economic conditions have many investors believing that the price of silver could quickly reach new heights in the coming months.

That’s why Steve Penny, the publisher of the Silver Chartist Report, has said regarding silver prices that “$50 comes pretty quick, probably not in 2021, but perhaps in the first half of 2022.”4

It’s also why top investors – including multimillionaire investors like David Einhorn and Jim Rogers – are now putting their money on silver.5 6

The top mining investor in the world – Eric Sprott – is also betting big on silver.

The top mining investor in the world – Eric Sprott – is also betting big on silver.

And he just put $2 million behind a little-known silver miner with immense upside potential – Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF).

So what does Mr. Sprott know that you don’t? Why does this currently “under-the-radar” company have such exciting profit potential? Let’s take a closer look.

Are Current Events Creating a

‘Perfect Storm’ for Silver Growth?

Several factors – including inflation, a global economy in transition, and the fear of more lockdowns – are driving investors and manufacturers to buy physical silver.

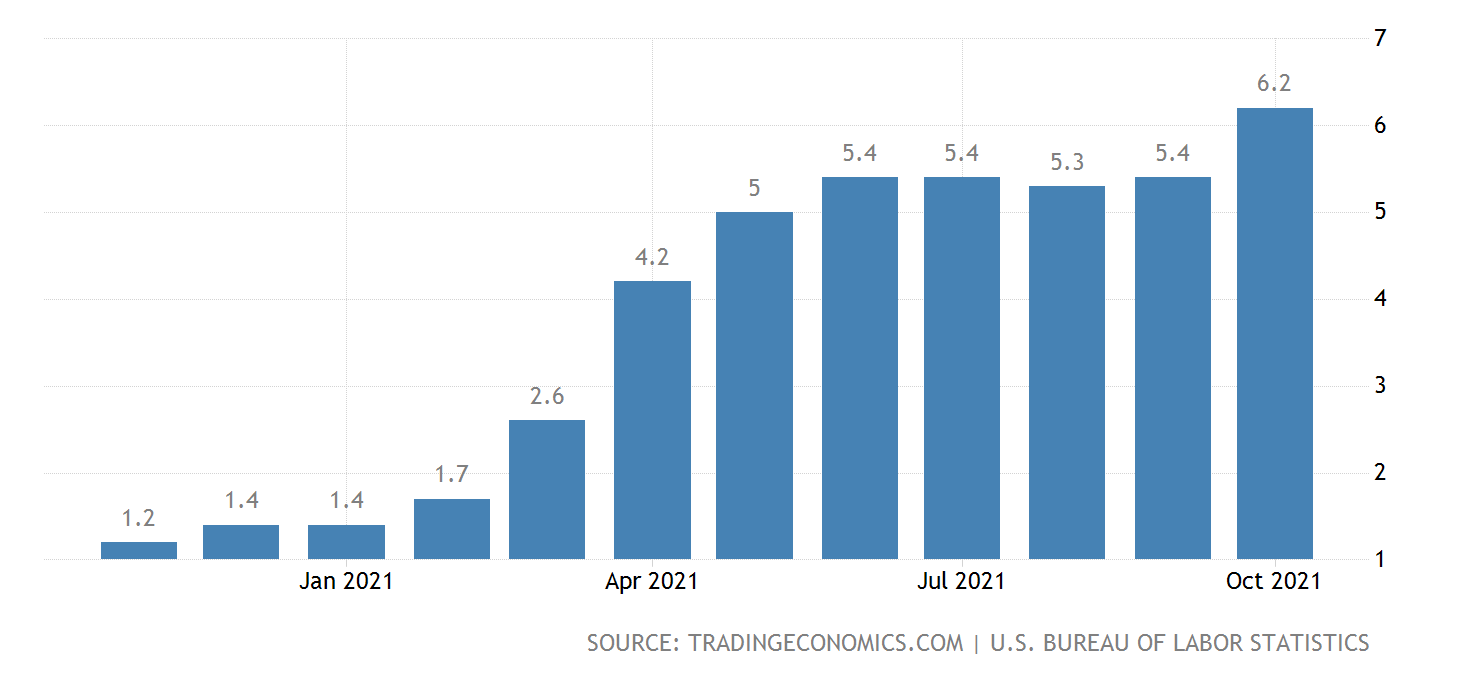

First of all, the US Fed has recently been printing money like crazy. How crazy? Well, 40% of ALL US dollars ever printed have been printed in the last twelve months!.7 All of that money printing has caused inflation to skyrocket to 6.2% in October 2021, marking the largest rise in three decades.8

That’s a 429% increase in a single year and it doesn’t look like it’s going to stop anytime soon!

At the same time that inflation is increasing, we also have new CV-19 concerns. As mentioned earlier, there is a new strain that’s sparking renewed health worries as well as concerns about how governments might respond to those worries.

When events like these cause uncertainty, many investors start turning to precious metals like gold and silver for safety.

And when it comes to investing in precious metals, there are two main strategies – buying physical gold and silver or investing in mining companies, where some of the biggest profits can be made through junior exploration companies.

That could be a reason why Sprott continues to bet on safe havens like silver. It’s also likely why he decided to put a large $2 million stake in junior mining and exploration company Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF).

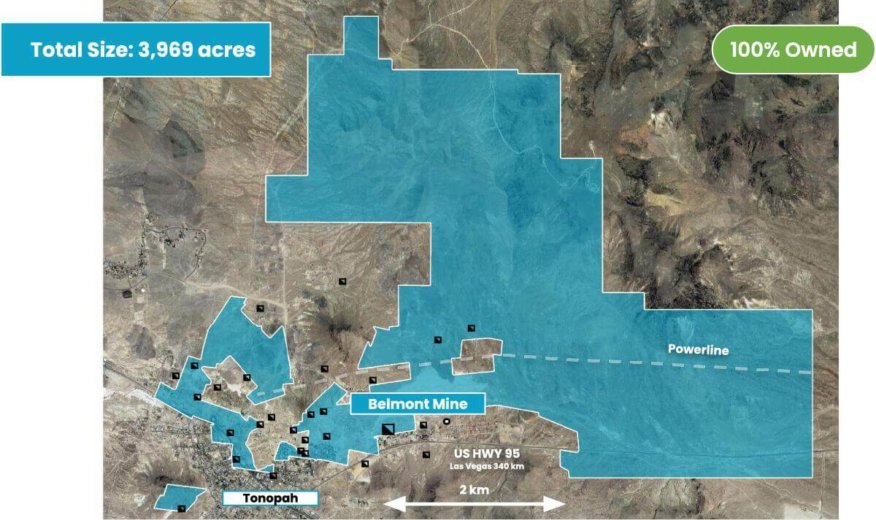

This is a company that just recently completed a non-brokered private placement financing that raised over $10M (including $2M from Eric Sprott). It has a solid structure with only 63.8m shares outstanding. Plus, it has 100% interest in the Hughes property in Nevada and the option to earn 100% interest in the Mogollon property in New Mexico.

To put it another way, Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) may be ideally positioned to excel in these uncertain times.

The Right Company…

In the Right Places… At the Right Time

One big industry problem right now is that there simply aren’t enough silver mining projects. And the ones that exist are concentrated in a small number of places like China and Latin America.

Three of the top five silver-producing nations (Mexico, Chile, and Peru) have the highest number of mining conflicts in Latin America,9 making the supply crisis even more complex.

Coupled with production in politically unstable jurisdictions, the lack of primary silver mines reinforces the need for a sustainable silver supply chain.

With its potentially lucrative mining properties in Nevada and New Mexico Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) could supply much needed silver at a time when demand is high.

The truth is Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) has 5 big advantages that could easily make it the breakout star of the silver market in 2022.

5 Reasons to Consider Investing in Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) Right Now

Reason #1 – High-Grade Gold and Silver Projects

Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) not only owns 100% interest in the Hughes property located in central Nevada, the company has the option to earn the Mogollon property located in southwestern New Mexico.

The Hughes property is home to the high-grade Belmont mine, one of the most prolific silver producers in the US between 1903 and 1929. The mine has been dormant since commercial production ceased in 1929 due to sharply depressed metal prices and little or no modern exploration work has been completed.

But now thanks to modern technology and a plan for upgraded infrastructure, Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) is positioned to be the first company to properly unlock the value of the mine

And, remember, it’s revisiting the mine at a time when the prices of precious metals, such as silver, have soared following the global economic downturn. And there’s plenty of silver ready to be mined in Nevada and New Mexico!

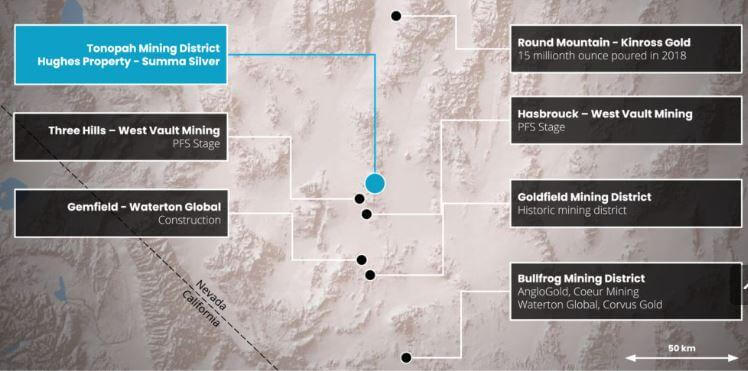

There has especially been a renewed focus on the epicenter of gold and silver mining in the United States: Nevada.

Mining in states such as Nevada and New Mexico offers a host of benefits like mining-friendly laws and regulations, and year-round mining conducive environment-friendly mining laws, and year-round mining-friendly climates.

Nevada’s mining industry is on the Fraser Institute’s rankings of the most attractive jurisdictions in the world. Nevada ranked third overall in 2019 and first in 2018.10

Those factors include a very mining-friendly bureaucracy in the state of Nevada, with fast permitting processes and a favorable industry tax rate.

Here is more information about the properties that could power Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) into becoming an industry leader:

The Tonopah Silver District

Discovered in 1900, Tonopah quickly became known as the “Queen of the Silver Camps.” Tonopah. During the months and years that followed, people from all over the country rushed to Nevada in hopes of making their fortunes. Over the next half-century, the Tonopah district produced 175 million ounces of silver and 1.86 million ounces of gold from 8.8 million tons of rock.12

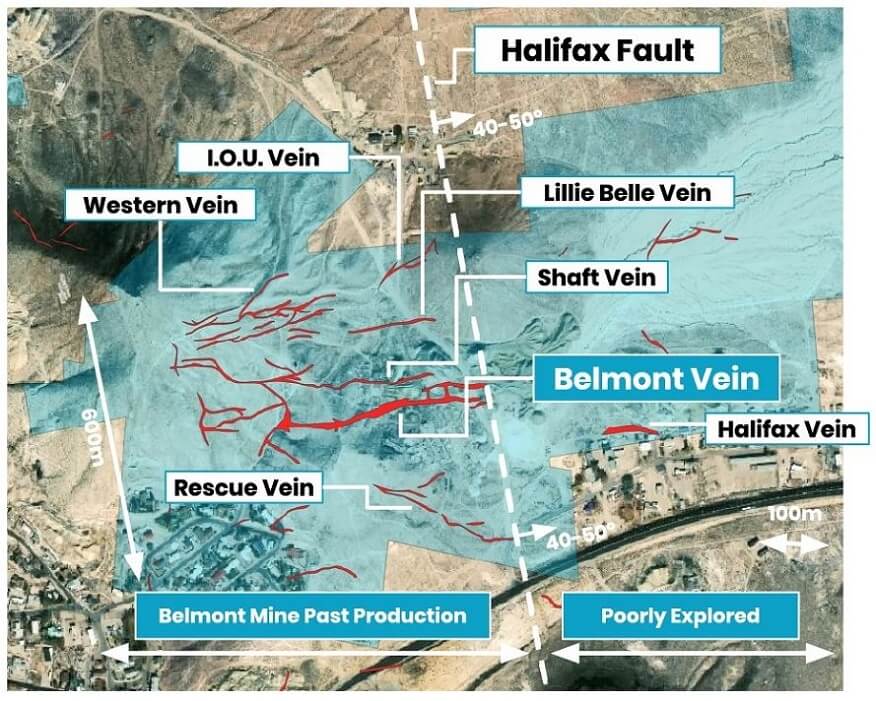

The potential for new discoveries on the Hughes property is high. Many of the veins previously mined at the Company’s Belmont and Mizpah Extension mines remain open.

Historically, the entire Tonopah district, much of which includes the Hughes property, was mined over a total length of 4 km. But the remaining 5 kilometers remain almost completely unexplored, ready for discovery.

At the Belmont mine, dozens of veins were discovered and mined during the early days of Tonopah. Operations here did not stop for lack of ore, but because of infrastructure limitations and low metal prices in the late 1920s.

Now Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) is targeting potentially lucrative unmined areas.

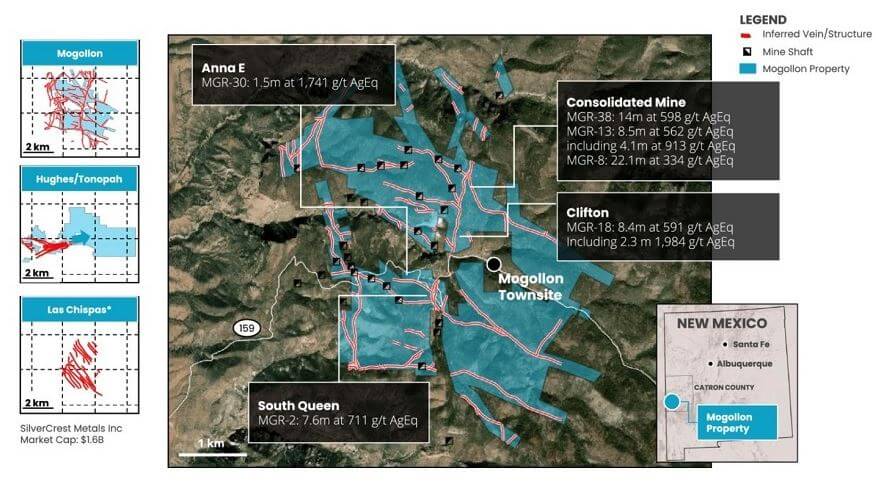

Mogollon – New Mexico

The Mogollon property, which has the potential to be one of the last remaining large vein deposits in the United States, was discovered in the 1880s by a U.S. Cavalry sergeant who kept the discovery secret until his service had ended. It is located 120 km from Silver City in southwestern New Mexico and covers an extensive field of epithermal veins containing silver and gold.14

Between 1904 and 1925, the district reportedly produced 13.1 million ounces of Ag and 271,000 ounces of Au from 1.39 million tons of rock. Production was halted in 1942 due to the wartime cessation of all gold and silver mining in the United States.15

Summa Silver Corp. (TSXV:SSVR) (OTCQB:SSVRF) officials believe that premature shuttering of the mine was a big mistake and that the property features under-explored and completely unexplored veins with strong potential for further mineralization immediately surrounding its historically high-grade producing mines.

This is why the company’s first 15,000m drill program will test targets on unmined extensions.

Press Releases

- Summa Announces the Grant of Stock Options to Officers, Directors and Consultants

- Summa Silver Intersects 50 Meter Vein Zone with Visible Mineralization in First Hole at Mogollon, New Mexico

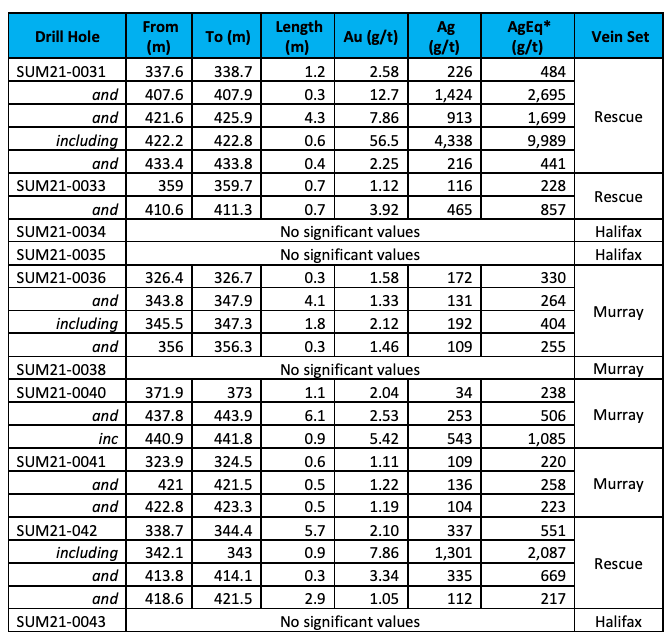

- Summa Silver Intersects 702 g/t Silver Equiv. over 3.9 m and 4,116 g/t Silver Equiv. over 0.4 m at the High-Grade Silver-Gold Hughes Property, Nevada

- Summa Silver Options Historic Eberle Mine at the High-Grade Silver-Gold Mogollon Property, New Mexico

- Summa Silver Commences Drill Program at the Historically Producing High-Grade Silver-Gold Mogollon Property, New Mexico

Reason #2 – Following in SilverCrest’s Footsteps

Is history about to repeat itself? Only time will tell; however, Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) appears to be showing several of the same signs that fellow Canadian miner Silvercrest did before it broke out and saw its value soar by 380%.

SilverCrest Metals is a Canadian precious metals exploration and development company based in Vancouver, BC, that has a production focus in Mexico’s historic precious metals districts.

Positive news from its Las Chispas silver-gold project saw shares increase from $1.90 in March 2019 to $9.12 on November 16. That’s a 380% increase!

Summa’s (TSXV:SSVR) (OTCQB:SSVRF) project, if it pans out to be anywhere as close as projections indicate, could be even bigger – meaning it could be in line for an even bigger increase in value.

SilverCrest is the first company to drill test the historic high-grade Las Chispas silver-gold project, a former producing site like the Hughes and Mogollon properties.

After beginning work on the property in 2016, SilverCrest identified high-grade silver and gold and even Bonanza-Grade areas on the property and has continued to intercept and expand the high-grade zones at Las Chispas.

Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) investors may be looking at the exact same path that the company could take with its own project, growing the company and hitting regular discoveries along the way.

As evidenced by the chart below, Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) already deserves mention among the market leaders and could surge all the way to the top in the coming year thanks to its Nevada and New Mexico projects.

All of the companies listed above are aiming at huge long-term growth in the precious metals space but it is Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) that has the projects and resources that really make it “one to watch” – including its premium location on the Hughes property.

Reason #3 – Modern Technology Meets Historic Silver Mining

Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) has used state of the art 3D mapping to find new silver reserves in areas that have been historically rich in the precious metal.

It has already announced the discovery of additional high-grade gold and silver mineralization in the first two holes of the year at the Hughes Property.

The company’s 10,000m 2021 drill program has finished with a focus on unexplored areas. New targets have been finalized for step-out holes around recently drilled high-grade intersections and holes specifically targeting new discoveries.

Here are some highlights from Hughes Property’s Belmont mine:

- Expansion of high grade shoots: drilling to date has demonstrated strong continuity of high grade mineralization in the Rescue vein system, where 15 holes have now been completed and grades often exceed 2,000 g/t AgEq.

- Stacked veins identified: Drilling in 2021 has so far confirmed the presence of several stacked mineralized veins within the southern portions of the Belmont mine, currently known as the Rescue vein system.

Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) is also assessing the potential for an NI 43-101 compliant resource at Mogollon and Hughes in Q4 2022, which could be huge catalysts for the company next year.

Reason #4 – Positive Mogollon Results Foreshadow ‘Bigger Things Ahead’

Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) also recently provided an update on the geological, geophysical and remote sensing surveys at its Mogollon property near Silver City, New Mexico. Things are going well:

- Surface Sampling: 326 rock samples were collected from a large number of prospective surface pits and trenches on the property, most of which were not previously sampled.

- Mine Sampling: Systematic sampling will commence at the Last Chance mine, where sulfide mineralized quartz veins were recently observed.

- Soil Sampling: A property-wide soil survey is underway and will focus on identifying blind exploration targets that may not have been recognized by previous operators.

- High-Resolution LiDAR Survey: A 29 km² LiDAR survey was conducted to provide topographic control and identify areas of surface disturbance peripherally and along strike from historical workings.

- Drone-based magnetic survey: 400 line kilometers of high-resolution drone-based magnetic data were collected to refine the property-scale structural model.

- Drilling in progress: Drilling is in progress on the Consolidated Extension target where the Company anticipates a minimum of 15,000 m of drilling is required. This first target represents only 1.5% of the total strike length of the vein and structure present on the property.

Summa Silver’s (TSXV:SSVR) (OTCQB:SSVRF) Mogollon property hosts approximately 34 km of near-continuous epithermal associated veins and faults where only 1.7 km of those veins and faults have been tested. Therefore, the Mogollon property offers a unique opportunity to build a high-grade resource near past historic production while systematically exploring for new discoveries using modern technology and techniques.

The 15,000m drill program started in Q3 2021 is targeting high-grade mineralization around the historic consolidated mine.

Progress has been swift, with surface exploration programs including geological mapping, prospecting, vein sampling, and soil sampling already completed.

Next up is a continuation of the drill program, and the expectation of the compilation and release of data including assays.

And of course, Mogollon will also be assessed for a NI 43-101 compliant resource in Q4 2022, just like at Hughes

Reason #5 – Led by Experienced, Highly Knowledgeable Mining Pros

The team behind Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) is a group of award-winning mining professionals focused on creating value through a modern, cutting-edge approach to mineral discovery. The leadership team includes:

RECAP: 6 Reasons

Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) Stands Out in the Red-Hot Silver Mining Market

1

Stability in an uncertain time – New CV-19 variant, inflation and lots of economic uncertainty are putting silver back in the spotlight. An under-the-radar junior exploration company with two big assets and the backing of top investors could be the ideal silver play at the ideal time.

2

Strong financials – The company just recently completed a non-brokered private placement financing that raised $10,168,000, including $2 million from the top mining investor in the world – Eric Sprott.

3

Modern technology – Thanks to its use of 3D mapping and other tech innovations, Summa Silver believes it has uncovered lucrative new silver reserves in some of the most silver-rich areas of the world!

4

Positive Results – A string of positive results, including most recently at the Mogollon property, could foreshadow that even greater things are ahead.

5

Target Rich Environment – Historically, the entire Tonopah district was mined over a 4km strike length. A further 5km remains almost completely unexplored with Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) now positioned to go where no one else has gone before!

6

Summa Silver (TSXV:SSVR) (OTCQB:SSVRF) is led by a true mining “dream team” that consists of the best and most experienced professionals who are all focused on achieving silver mining success through state-of-the-art methods and old-fashioned hard work.

Galen McNamaraCEO and Director

Galen McNamaraCEO and Director Chris YorkExploration Manager

Chris YorkExploration Manager Christopher LeslieSenior Geologist

Christopher LeslieSenior Geologist