The first step in purchasing an investment property is deciding where to buy it. But how do you navigate all 50 states to find the best real estate market to invest in? Property taxes, landlord-tenant laws, and rising rent prices are all factors to consider.

To get you started, here are five states with a lot of potential and five states where real estate investing might not pay off. We compiled the list using data from Zillow, Data USA, Apartment Guide, and WalletHub. Continue reading to learn more about investing in real estate across the country.

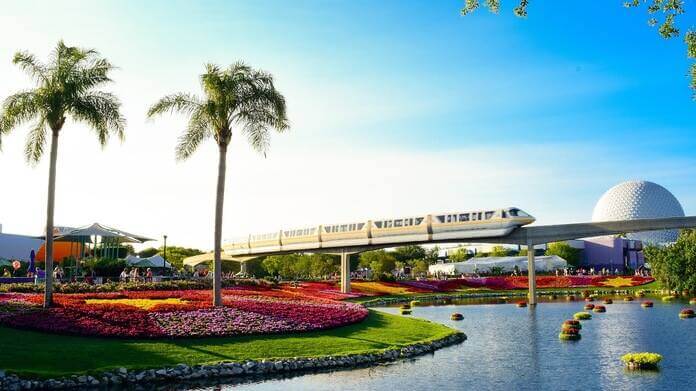

Best: Florida

-

- Typical Home Value: $397,280

- Year-Over-Year Home Value Change: +34.3%

- Average Monthly Rent: $2,271

- Year-Over-Year Rent Change: +37.56%

- Effective Property Tax Rate: 0.89%

The Sunshine State could be a gold mine for rental property investors because its population is consistently growing — and approximately 34% of its residents rent rather than buy. As a result, there is a consistent pool of tenants. According to Rocket Mortgage, this is especially true in Tampa and Jacksonville, where job growth is strong.

Jacksonville, in particular, has hit a real estate gold mine. On the one hand, the source claims that the median list price is significantly lower than the national average. On the other hand, home values have risen by 20% since 2021. Furthermore, according to New Silver, Florida is landlord-friendly, with no rent control, late fee restrictions, or security deposit limits.

Pixabay

Best: North Carolina

-

- Typical Home Value: $320,291

- Year-Over-Year Home Value Change: +27.4%

- Average Monthly Rent: $1,584

- Year-Over-Year Rent Change: +29.04%

- Effective Property Tax Rate: 0.84%

To name a few, Bank of America, Lowe’s, and LendingTree have their headquarters in North Carolina. According to Rocket Mortgage, job growth in Charlotte is expected to be 45.2% this decade. As a result, there may be a high demand for housing.

According to the source, the population of the Raleigh-Durham metro area is expected to grow over the next 15 years. The source describes the region as an “attractive market” for investors interested in high-end rentals due to population growth and job opportunities in technology, science, and research.

Pixabay

Best: Georgia

-

- Typical Home Value: $320,291

- Year-Over-Year Home Value Change: +27.1%

- Average Monthly Rent: $1,666

- Year-Over-Year Rent Change: +29.34%

- Effective Property Tax Rate: 0.92%

Georgia is another state where real estate investors can make a lot of money. About 36% of residents rent, and jobs continue to attract newcomers to Peach State. Take, for example, Atlanta. According to WABE, the city has experienced “tremendous in-migration” and “tremendous job growth,” creating a demand for single-family rentals.

Atlanta’s housing market is overpriced, but this isn’t necessarily bad for investors. You don’t have to be concerned about short-term market downturns if you’re making a long-term investment. High prices also keep potential buyers out of the market, keeping them trapped in the rental cycle. Furthermore, Georgia is regarded as a landlord-friendly state.

Pixabay

Best: Arizona

-

- Typical Home Value: $450,629

- Year-Over-Year Home Value Change: +26.3%

- Average Monthly Rent: $2,092

- Year-Over-Year Rent Change: +33.79%

- Effective Property Tax Rate: 0.66%

Arizona offers several benefits to rental property investors. For one thing, property taxes in the state are low. Rents and home values are both rising. Furthermore, according to New Silver, landlords can raise the rent at any time with a 30-day notice, and eviction laws also favor landlords.

Phoenix, in particular, could be a wise investment. It’s a growing tech hub with Amazon, Uber, and Yelp offices. There is also plenty of sunshine and golf courses. As a result, the city appeals to many people, from remote workers to retirees.

Pixabay

Best: Idaho

-

- Typical Home Value: $475,113

- Year-Over-Year Home Value Change: +15.0%

- Average Monthly Rent: $1,429

- Year-Over-Year Rent Change: +21.72%

- Effective Property Tax Rate: 0.69%

The Gem State, it turns out, is a gem for rental property investors. For one thing, the property taxes are low. Combined with rising monthly rents, this results in high net cash flow from investment properties.

Like the other top investment states, Idaho is fast-growing with a steady influx of potential renters. Furthermore, property values have steadily increased. As a result, investors can buy with confidence.

Pixabay

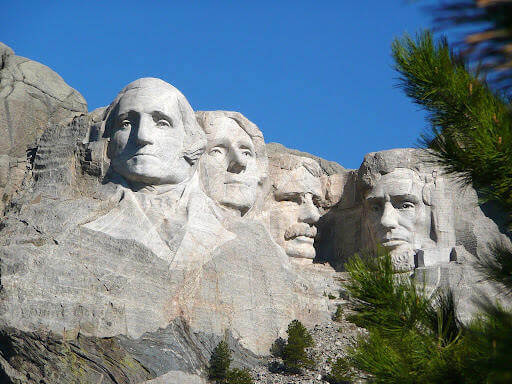

Worst: South Dakota

-

- Typical Home Value: $291,501

- Year-Over-Year Home Value Change: +16.8%

- Average Monthly Rent: $903

- Year-Over-Year Rent Change: -13.24%

- Effective Property Tax Rate: 1.31%

South Dakota is one of the few states where rent prices have decreased. That is just one of the reasons why investing in South Dakota real estate may not be profitable. High property taxes and a decline in employment are also factors to consider.

“From 2018 to 2019, employment in South Dakota declined at a rate of 2.04%, from 425k employees to 416k employees,” according to Data USA, so it isn’t exactly full of boomtowns like some other states.

Pixabay

Worst: Michigan

-

- Typical Home Value: $236,980

- Year-Over-Year Home Value Change: +14.6%

- Average Monthly Rent: $1,318

- Year-Over-Year Rent Change: +12.63%

- Effective Property Tax Rate: 1.54%

Michigan has deteriorated from a thriving automotive manufacturing hub to a shell of its former self over the years. There were signs of revitalization, such as slow population growth between 2010 and 2020.

According to The Detroit News, the Great Lakes State’s population is again declining. As a result, housing demand is unlikely to increase anytime soon. Then there are the high property taxes to consider.

Pixabay

Worst: Illinois

-

- Typical Home Value: $266,415

- Year-Over-Year Home Value Change: +14.0%

- Average Monthly Rent: $1,619

- Year-Over-Year Rent Change: +15.05%

- Effective Property Tax Rate: 2.27%

Illinois has some of the highest property taxes in the country. As a result, the profit potential of investment properties can be significantly reduced. Furthermore, the state’s population is declining.

According to the Illinois Policy Institute, 2021 will be the state’s eighth consecutive year of population decline. According to the source, “better housing and employment opportunities” elsewhere drive outmigration.

Pixabay

Worst: New York

-

- Typical Home Value: $405,105

- Year-Over-Year Home Value Change: +13.9%

- Average Monthly Rent: $2,530

- Year-Over-Year Rent Change: +19.74%

- Effective Property Tax Rate: 1.72%

Rental property investors should think twice before investing in New York. This is due in part to New York’s high property taxes. However, landlords face additional challenges.

For example, “the Big Apple doesn’t make it easy for landlords, with rental laws that change on a dime and a slew of restrictions,” according to New Silver, so make sure you understand how New York’s landlord-tenant laws work.

Pixabay

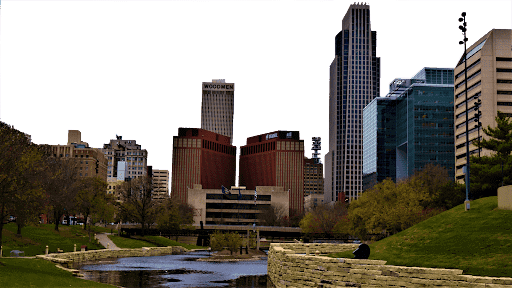

Worst: Nebraska

-

- Typical Home Value: $239,574

- Year-Over-Year Home Value Change: +12.3%

- Average Monthly Rent: $1,316

- Year-Over-Year Rent Change: +9.29%

- Effective Property Tax Rate: 1.73%

Nebraska is another state where rent prices aren’t always trending in the right direction for rental property investors. While prices did not fall everywhere, they did in some Omaha suburbs.

According to Apartment Guide, rents fell 8.8% in Elkhorn, 5.4% in Papillion, and 3.4% in La Vista. Furthermore, property taxes in Nebraska are high.

Pixabay

Featured Image: Pixabay @ Nature_Design