Your credit score is very significant. It incorporates all parts of your financial life into a single three-digit figure, including your debt load, credit limitations, loan history, credit card usage, and even utility payments. The figure represents your credit score. Even if you’re not conscious of it, it’s in charge of many significant aspects of your life.

The cost of your borrowing is based on your credit score. For instance, when you finance a new car or apply for a mortgage. It will depend on what interest rates you pay on personal loans or credit cards. It might also affect submitting a job application or finding a new home to reside in.

It’s reasonable to have further inquiries because credit ratings affect many aspects of our lives. Where did credit ratings originate? Who makes the calculations for them? The most crucial question is: Are they even fair?

A credit score: what is it?

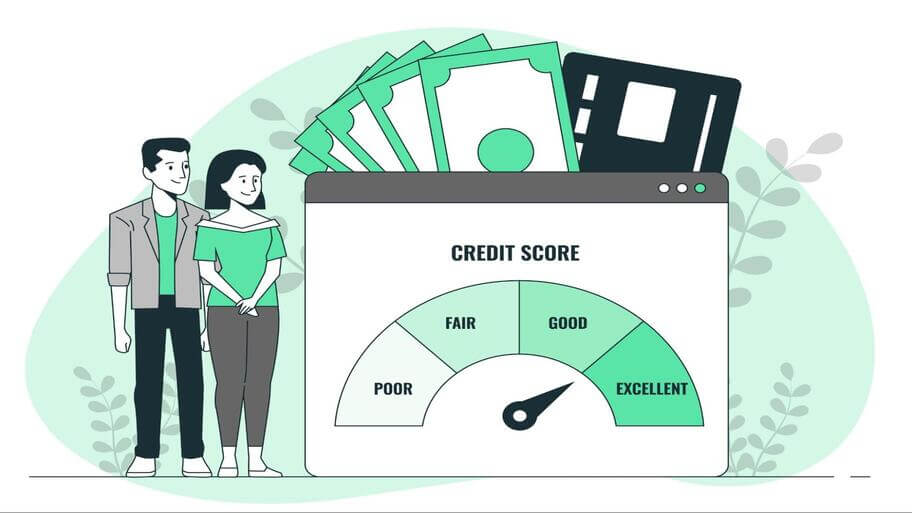

Simply put, a credit score is a three-digit figure ranging from 350 to 850. (or sometimes 900). Your credit is worse the lower the number. Any score below 580 is typically regarded as poor. Between 580 to 740 points are considered fair or reasonable. Any score above 740 is considered very good, and anything over 800 is considered superb.

You may quickly rank your creditworthiness using these statistics. In other words, lenders will use this score to assess whether taking a chance on you by granting you a loan is good or bad. In essence, it’s an informed judgment as to how likely you will cease paying payments on time or completely default on the loan.

Credit Report vs. Credit Score from Shutterstock

Your credit report is far more extensive than your credit score, which is just a number. It includes every piece of raw information utilized to calculate your credit score. Your previous credit history is included in that information, including any paid-off and closed loans or credit cards. Your mortgage information and other public records may also be included.

Additionally, your credit report will include any warning signs you may have noticed. That covers missed payments and debts that were collected. A list of all the times someone has run a credit check on you will also be displayed. Applying for a loan, mortgage, or credit card, among other things, usually involves a credit inquiry. Before hiring or renting to you, landlords and some employers may also check your credit.

Your Credit Score Is Determined By Who?

There are three major credit bureaus in the United States (although there are smaller ones too). They are TransUnion, Experian, and Equifax, in no particular sequence. All three are independent businesses that determine your FICO score using data from your credit record. (FICO stands for Fair Isaac Corporation, a business that contributed to the development of the credit score concept.)

Since the three major credit agencies each use a slightly different formula to calculate your score, your FICO credit scores may vary slightly. They probably won’t differ much enough to make a difference, though. The only exception would be if you had a particular creditor that, for whatever reason, doesn’t send information to one (or more) of these agencies.

How To Calculate Credit Scores

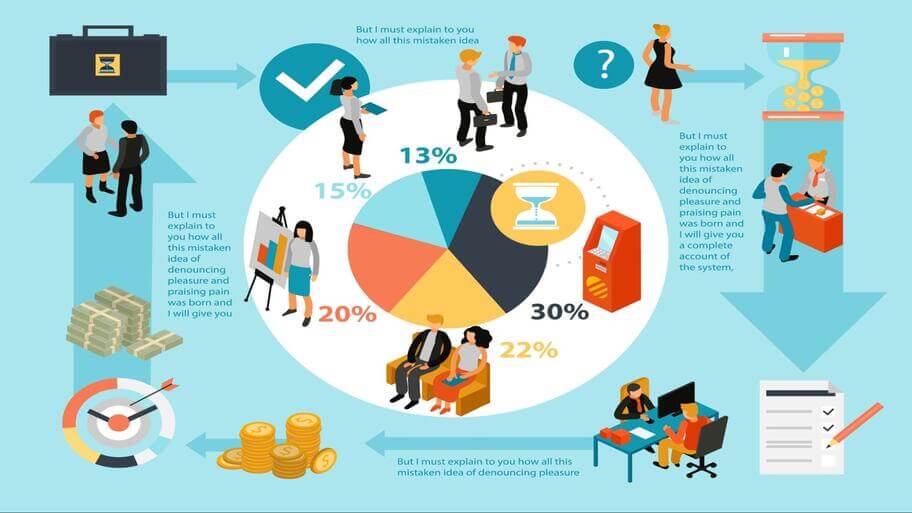

You should know some overall percentages, even if each credit bureau calculates your score slightly differently. 35% of your score is determined by your payment history, including on-time and late payments. Your credit score can decrease if you frequently make late payments. On the other hand, a spotless record of on-time payments will significantly boost your score.

The amount you still owe on credit cards, lines of credit, or other loans makes up 30% of your score. The term “credit utilization” may be used to describe this. Your credit score will suffer if you routinely use all your available credit.

The length of your credit history (15%), the variety of credit you have (10%), and recent credit activity (10%) make up smaller portions of your credit score.

There are several variables, even within those constraints. However, the two biggest things you can do to maintain your credit score are to avoid taking on more debt than you can manage and to make on-time payments on all of your bills, including the minimum payments due on your credit cards or lines of credit.

Who developed credit ratings?

The past of credit ratings is somewhat hazy. Technically, the current FICO score wasn’t fully developed and implemented until 1989. The Fair Isaac Company, on the other hand, was founded in the 1950s. The most recent addition to the algorithm, in 2014, included the addition of rent payments and a lesser weighting for medical debt. Over time, more criteria have been added to the calculation.

There was still such a thing as excellent and bad credit prior to Fair Isaac. Retailers began keeping their own records on which of their customers were more likely to repay a debt as early as 1912. They quickly began exchanging viewpoints with one another and building the first ad hoc database of credit ratings. But as we’ll see more clearly in a moment, these ratings were frequently incredibly arbitrary or even prejudiced.

Are credit scores discriminatory or biased?

Early credit ratings took into account factors other than finances. They were probably going to contain details about people’s private social, political, or even sexual life. You can easily picture the prejudice that a minority (who was otherwise excellent with money) may have experienced. There are innumerable instances of persons who have rejected loans despite having the means to repay them due to their race or sexual orientation.

In theory, identifying characteristics like ethnicity, gender, political affiliation, disability, and sexual orientation should no longer be included in credit scores today. However, detractors of the system continue to claim that it is excessively prejudiced. Poor credit makes borrowing money more expensive, thereby trapping some segments of the population in an endless cycle of debt. Credit scores are occasionally used to assess rental applications or make hiring decisions. Again, a magic number that folks with lower scores have little control over prevents them from making real-life improvements.

Reducing Bias

To their credit, governments have intervened throughout time to make an effort to make credit scores more equitable. They passed the Fair Credit Reporting Act in 1970. The credit bureaus are prohibited by this statute from putting personally identifying information in their reports. It also increased transparency for customers to view and contest information on their credit reports.

According to the Fair Credit Act, debts must be removed from credit reports after a specific period of time. You may have heard that bankruptcy declarations only apply for seven years. That originates from this.

Unfortunately, there are other factors that are more important in evaluating your eligibility for a loan, credit card, mortgage, employment, or new apartment than your credit score. According to experts, only 20% to 40% of such decisions will affect your score. The remainder will depend on additional elements like your salary, age, and even ZIP code. Additionally, if you must apply in person, your appearance or accent might even be used against you in a subliminal way. (However, no banker would ever publicly confess that.)

Credit Scores of the Future

Credit scores won’t disappear any time soon. Nearly every business or organization that you would need to ask for credit consults them. The good news is that several businesses are beginning to downplay the significance of credit ratings. More customers are now given a chance to explain the circumstances around their poor scores rather than being outright declined for a loan due to a low credit score. If the justifications are true, you might still be eligible for the credit.

Additionally, lenders have created their own scoring systems. You might never find out the precise reason why one bank rejected your application while another approved it because these calculations are confidential. Your financial life will undoubtedly continue to depend heavily on credit ratings, which are likely to change over time. But the tide is turning away from them as the deciding factor.

Methods for Obtaining Your Credit Score (and Report)

It’s simple to obtain a copy of your credit report. All three main credit agencies are required by law to provide you with one free copy each year. It’s worth investigating because you could also be able to see your credit report further through your bank or credit card. Visit AnnualCreditReport.com or dial 1-877-322-8228 to obtain one.

Each bureau includes a method of contact if you find an error or have a problem. If you are denied credit for any reason, you can potentially be eligible for further credit reports. Keep in mind that requesting a copy of your credit report will in no way affect your score. This is an accepted myth. There is no cost associated with looking at your score yourself, even though having several creditors examine it quickly may cause it to decline.

The Conclusion

Credit reports can aggravate you. A strong score can take months (or years) to accumulate, but that progress can be undone in an instant with one poor choice or a run of terrible luck. Nevertheless, a crucial component of your financial identity is your credit score. Your credit score is important if you ever want to get a mortgage, apply for a credit card, get a student loan, or purchase a car.

Although credit ratings have long been condemned for being discriminatory (and rightfully so), things are changing. Credit scores no longer contain any personal information, and some lenders are not as concerned with them as they formerly were. However, you should keep a tight eye on your credit score. You ensure that your report is accurate and comprehensive. Make sure to review it every year. If not, you can be in for a nasty shock the next time you need to apply for credit.

Featured Image: Freepik.com