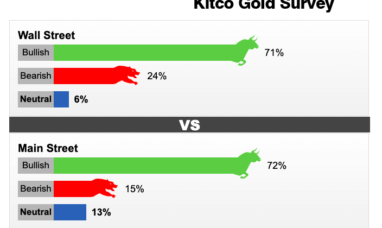

Gold is making a serious comeback that even the biggest market bears can’t ignore.

Investors are realizing that high inflation is here to stay and it‘s created the strongest gold bullion demand in over two decades.¹

U.S. Mint just reported its best March performance since 1999, selling 155,500 ounces of its American Eagle Gold bullion coins, a 73% increase from February.

Meanwhile, spot gold price once again surpassed $2,000 per ounce earlier this month and could break its previous record high of $2,072.50 from August 2020² as geopolitical uncertainty and even higher inflation is sending a new wave of inflows into the sector.

According to Equity Capital analyst David Madden, “The gold market is in a very strong uptrend. In the current environment, there is very little that could derail the rally to higher prices.”³

Singapore’s United Overseas Bank (UOB) says it expects the price of gold to end the year at $2,200.⁴

And when you consider the current state of the world, it’s easy to see why everyone has their eye on safe-haven investments like gold.

Just look at what happened to gold prices during the last two years when CV-19 effectively changed the world as we know it.

Breaking News

Not interested in hoarding gold coins or bars? Take the Buffett approach: Don’t invest in gold, but the companies that surround it.⁵

Because even though bullion can be a good investment, when gold demand and prices rise like they are now it often means big gains for gold mining companies…

Especially X-factor-type mining stocks like Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF), which just recently unveiled a clear and accelerated path to develop its Kenville gold mine.

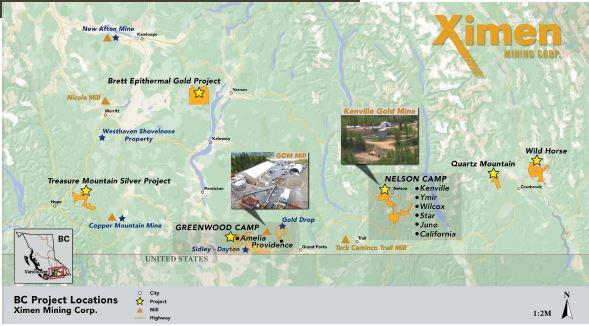

Ximen is on track to becoming the next significant high-grade gold company in southern British Columbia, one of the best mining jurisdictions in the world.

And its progress couldn’t be coming at a better time in the marketplace.

Capital.com says that “rising inflation and a slow-growth environment have increased the likelihood of potential stagflation. While equities generally perform poorly in this kind of economic environment, exposure to gold and energy may help insulate investors.”⁶

In other words, these economic conditions are the perfect time for mining companies like Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) to stand out.

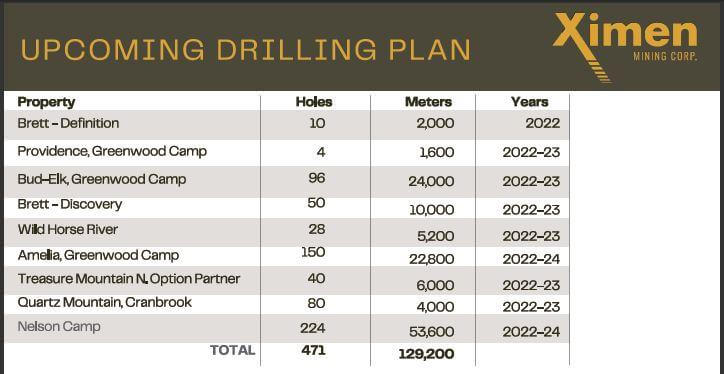

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is not only preparing for mine development that’s aiming for gold production at its Kenville Project but it also has an expansive drill campaign planned for all of its projects (over 130,000 meters in total⁷) planned through 2024.

This is an exploration and mining company that clearly intends to increase its operations and begin mining gold during a period where gold demand is also expected to be increasing exponentially.

But what separates Ximen from the competition?

6 Reasons

To Add Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) to Your Watchlist

1

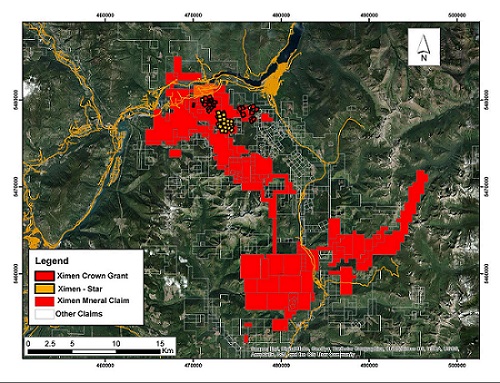

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) holds a HUGE Land Package at a Forgotten Yet Potentially Highly Profitable Mine – Kenville consists of 20,092 hectares of highly valuable land.

2

Gold and Gold Stocks are Outperforming Everything – Spot gold ripped through US$2,000 with big momentum to go way higher along with gold mining stocks.

3

New Gold’s $2M investment for 9.9% of the company and 26% owned by insiders is a tightly held share structure with a highly-experienced management team.

4

More than compliant: Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) has always had a strong ESG initiative and is a leader in clean exploration practices in BC

5

No one trick pony: Ximen’s properties and project portfolio is vast, high-potential, and holds multiple opportunities for profitable high-grade discoveries and potential production in its project pipeline in the short and long-term.

6

Management-driven vision and success: Ximen has mining industry veterans that have had multiple successes at the highest level, in difficult bear markets and more.

That’s just a peak at the many positives that Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) has going for it. Let’s take a deeper look at what this gold company has to offer.

Reason #1 – Discovering New Potential in a Historic Mine

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) flagship Kenville Gold Mine was the first underground mine in British Columbia. It produced 65,381 oz gold and 27,685 oz silver between 1889 and 1954. And then it was ultimately forgotten … until now.

Three recent drilling programs discovered a new, untouched vein system directly south and west of the original mine. Here’s what Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) reports:

- Drilling produced consistent intersections, on multiple veins, over a distance of 700m with 250m dip length

- Veins are open to the south/west/east and to depth. Intercepts range from .28 meters to .94 meters

- Grade ranges between 26.6 g/tonne to 88.1 g/tonne

- Favorable metallurgical results of 99% combined gold recovery

What all that means is this is a significant gold find with lots of potential – and Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is now the sole owner of the 20K hectare property – No CAPEX!

The company has been quick to create a conceptual development plan for its find.

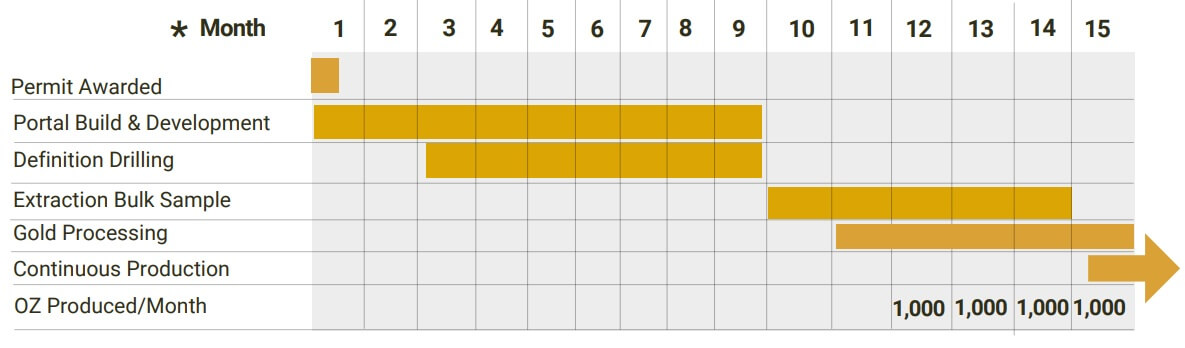

Permit applications have been submitted and on March 15, Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) was notified that it would receive a draft permit for the proposed mine development and underground drilling within 30 days.⁸

Once it has received the draft permit, the company will review it and either accept the draft or request revisions. Once accepted by both parties, the permit will be issued. Concurrently, an environmental discharge permit is expected to be issued as well.

That means Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) could be up and running on its Kenville Gold Mine project sooner rather than later.

Once that permit becomes official, Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is planning a 1200-meter decline and 20,000 meters of drilling. Based on current models, it is fully expected that drilling will outline a 10,000-tonne bulk sample. The company then plans to move to a bulk sample permit and a small mine permit to maintain a smooth path to continuous mining.

Another great thing about the Kenville Gold Mine project is that infrastructure – including roads, hydropower and a local experienced workforce – all already exist. That significantly reduces the company’s expected project expenses.

Plus, as stated earlier Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) owns 100% of the projects AND all of its own equipment meaning no CAPEX.

It appears to have everything lined up so that it can become the next exploration company to move into gold mining.

Reason #2 – The Soaring Price of Gold

Fears about stagflation, which refers to when an economy is experiencing both an increase in inflation and a stagnation of economic output, are skyrocketing in the US and Canada.

“Stagflation is a general economic mess, and while we think it’ll only last a year or two while the supply side sorts itself out, gold will be a choice asset,” Seeking Alpha⁹

Rising inflation along with volatility brought on by the war in Ukraine are sending investors in search of safe-haven investments like gold.

In March, CNBC reported that “gold prices rose to more than a one-week high … as its safe-haven appeal was lifted by concerns over soaring inflation and uncertainty surrounding the war in Ukraine.”¹⁰

At that time, spot gold broke past $2,000 per ounce,¹¹ building upon previous gains. At the same time, U.S. gold futures rose to $1,962.20.

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is uniquely positioned to capitalize on the elevated gold prices thanks to its near-term Kenville Gold Mine. Plus, increased investor interest in the market will help fuel the development of its other mining projects.

This could be a mining company that sees big gains in the near future. Here is how it compares to its peers in the marketplace:

Gold stocks have been consistently outperforming the broader market lately. Ximen investor and NYSE American-listed New Gold is up 50% in the last six months, from $1.18 on October 6, 2021, to $1.77 on April 5, 2022.

Centerra Gold isn’t far behind, with a nearly 30% gain from C$9.59 October 6, 2021 to C$12.43 on April 5, 2022!

But is it a fluke? Definitely not. Just take a look at Tudor Gold’s 227% gain in just two years! The stock went from C$0.58 on April 9, 2020, to C$1.90 on April 5, 2022.

During one of the biggest financial crises of the era, gold stocks have been crushing it.

And they’re doing it in BC, a world-class mining jurisdiction.

Consider how peers like Skeena Resources are knocking it out of the park, right in Ximen’s backyard of beautiful BC.

Skeena just signed a cash and stock deal to acquire QuestX Gold and Copper for C$48.6 million, which owns several high-value, high-grade properties in BC. And will immediately sell a handful of QuestX properties to mining giant Newmont, for C$27 million.¹²

Land packages and projects in BC are so hot, they’re trading hands like prime real estate in New York or Miami!

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) could have its breakout at any moment, and investors aren’t just getting a great company – they’re getting exceptional projects.

And remember, Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) has 100% ownership of its projects and equipment. This is a company that is planning on self-funding exploration in the future once its Kenville project is producing and it has no major long-term capital expenditures (CAPEX) on the books.

Press Releases

- Ximen Mining Actively Progressing Kenville Gold Mine

- Ximen Mining Expands Market Awareness

- Ximen Mining’s April Drill Program Targeting Bud Elk Copper Gold Porphyry Targets

- Ximen Mining Identifies Geophysical Gold and Copper Targets at The Bud-Elk Project

- Ximen Mining Development Permit for the Kenville Gold Mine – Nelson BC

Reason #3 – A Vote of Confidence From a Grade-A Mining Company

New Gold Inc, that company that’s up 50% in the last 6 months, is also a major investor in Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF).

New Gold took a 9.9% stake in Ximen through a non-brokered private placement worth C$2,534,686 and immediately highlighted why this company is so fascinating to investors.

Not to mention, insiders own 26% of the company too. With New Gold’s 9.9% stake there is a strong 35.9% stake controlled by the investors running the company and that are intimately familiar with the value each project brings to the portfolio.

Investors buy low and sell high. And that’s what’s happening here. Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is highly undervalued right now considering its market cap of just C$19.7 million as of April 5, 2022.

Just the Kenville Gold Mine alone could be worth far more than that. The company owns 100% of the property, comprising an absolutely massive 20,062 hectares.

The roadmap will make this an incredibly valuable asset for these highly sophisticated investors.

And not in 10 years either; the current roadmap leads to a steady 125 tonnes a day and potential gold recovery of over 1,000oz/month in just one year after permits are granted.

Reason #4 – Environmentally-Friendly Mining at its Finest

The Environmental, Social, Governance movement sweeping across numerous industries is having a significant impact on mining.

Shareholders and institutional investors are demanding a strong ESG commitment from the companies they put their money in. It’s reached the point where companies that don’t meet rising demands for sustainable and environmentally friendly mining are going to be left behind.

For instance, BlackRock announced in 2020 that it was divesting coal-related assets and creating funds that avoid fossil fuel stocks.¹³ Other top mining capital providers also followed suit.

UBS announced it was no longer going to finance new oil sands projects. Norges Bank removed oil sands producers from its trillion-dollar national wealth fund. Mitsubishi UFJ Financial Group added oil sands extraction to its restricted transaction list.¹⁴

Access to capital is becoming extremely difficult for companies that do not meet new ESG requirements.

An EY report titled “Top 10 Business Risks and Opportunities for Mining and Metals in 2022” listed environmental and social issues as the number one risk for mining companies operating today.¹⁵

The good news for Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is that it has long made environmentally-friendly mining practices a central part of doing business.

Ximen is committed to being a leader in sustainable mining and responsible development in BC and has set a goal of maintaining as small an environmental footprint as possible as it moves its many mining and exploration projects forward.

“A greener economy cannot exist without mining,” said Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) President and CEO Christopher R. Anderson. “It is our responsibility as a mining exploration and development company, to implement green solutions and technology in all our operations whenever feasible. We believe we are being part of the solution contributing to the survival of our industry and our planet.”

Anderson and other Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) officials are taking their role of bringing greater environmental safety to the mining industry seriously.

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) represents a new generation of mining companies that are committed to environmental safety.

Reason #5 – Ximen is Not a ‘One Trick Pony’

In addition to the Kenville Gold Mine Project, Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) has a number of other promising projects in its pipeline. For instance:

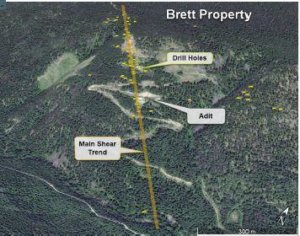

Brett Epithermal Gold Project

Ximen has 100% ownership of this 20,025 hectare gold project situated in Southern British Columbia near the city of Vernon. Historical intercepts from this property include up to 168 g/t over 1.3m core length, with visible gold being common. In 1995-1996, 291 tonnes of surface trench samples graded at 28 g/t gold and 64 g/t silver.

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) says Northwest trending gold shears are located roughly 50 to 60 meters apart and can be followed along strike for at least 1200 meters and occur over at least 1 kilometer in an east-west direction. The potential exists for 15-20 parallel gold-bearing shears.

Amelia Gold Mine Project

Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) acquired mineral properties covering the historic Cariboo-Amelia gold mine in Camp McKinney near Mt. Baldy Mountain Resort in Southern British Columbia. This acquisition added to Ximen’s significant property holdings in the region.

The Cariboo-Amelia was BC’s first dividend-paying lode gold mine and was the most significant producer from Camp McKinney. Over its intermittent 68-year mine life from 1894 to 1962, the Cariboo-Amelia produced 124,452 tonnes ore, of which 112,254 tonnes are reported as milled on site. Recovery included 81,602 ounces of gold, 32,439 ounces of silver, 113,302 pounds of lead and 198,140 pounds of zinc (lead and zinc since 1940). The average recovered gold grade was 24.68 grams per tonne gold (from BC Minfile).

Permitting for drilling was completed in 2021 and Ximen is ready to begin testing this property for its huge gold potential. Amelia is only one part of the Ximen’s Greenwood Camp holdings, which also include Bud-Elk and Providence properties.

And Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) has a solid upcoming drill plan that includes nearly 130,000 meters of drilling through to 2024.

Reason #6 – Exceptional Leadership Team With Proven Mining Experience

Members of the Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) leadership team include:

This is clearly a company that has a lot of things going for it and that’s why we are recommending that you begin doing your due diligence on it right away. To help you get started, here is a recap of the primary reasons to consider investing in Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF).

RECAP: 6 Reasons

Ximen Could Quickly Surpass Its Peers in the Gold Exploration & Mining Market

1

Stagflation, the Ukraine War and other volatility is driving interest in safe haven investing and putting well-positioned gold mining companies like Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) in the spotlight.

2

Ximen Mining Corp. holds a HUGE Land Package at a Forgotten Yet Potentially Highly Profitable Mine – Kenville consists of 20,092 hectares of highly valuable land.

3

New Gold’s $2M investment (9.9% ownership) and 26% insider ownership creates tightly held share structure

4

ESG-Focused: Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) has always had a strong ESG initiative and is a leader in clean exploration practices in BC

5

No one trick pony: Ximen’s property and project portfolio is vast, high-potential, and holds multiple opportunities for profitable high-grade discoveries and possible production in its project pipeline in the short and long-term.

6

Management-driven vision and success: Ximen Mining Corp. (TSXV:XIM) (OTCQB:XXMMF) is guided by some of the top mining officials in the marketplace, including a CEO who successfully navigated one of the most challenging bear markets in mining history.