Silver has underperformed gold this year – but the tides are slowly turning.

You see, the silver supply squeeze is only getting worse by the day as one of the world’s largest stockpiles of silver continues to plummet.1

Throughout 2021, silver inventories in the LBMA vaults in London have consistently fell each and every month.

In fact, it has now reached an all-time low – yet silver prices are still sitting at a multi-year low.

It’s only a matter of time before the market corrects itself and silver scarcity could potentially cause the price of silver to increase..

In 2021, global demand surged 19% to its highest level since 2015, with industrial demand hitting an all-time high.

At the same time, silver suffered its most significant shortage in over a decade.2

This year, global demand could reach a record high of 1.112 billion ounces,3 a 5% increase over last year.

This would push the silver market into another deficit 38% larger than the one experienced last year.4

But what is the best way to get in on the silver market?

Look for a junior exploration company with a team that has been involved with significant discoveries and M&A deals in the past, working in world-class regions, and are once again focusing on their next win.

A perfect example is Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF), a company that has many wondering if it could be the next big thing in the silver mining market.

In 2021, rock samples from Tier One’s Curibaya Project returned multiple areas with +1000 grams per ton silver.

Not only did recent drilling produce high-grade silver results, but it also found potential for a major copper deposit as well.5 This is a rare phenomenon to have both a high-grade silver system and the potential for a large copper porphyry discovery, all in one.

When you consider that copper is also proving to be a very hot commodity right now – with demand expected to double by 2035 for the same reasons as silver6 – companies like Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF) have investors doing more due diligence to get the facts about their properties in Peru.

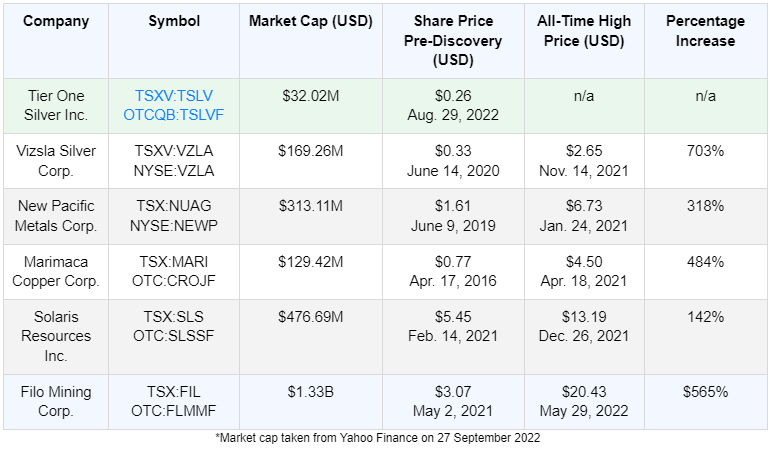

Great Mining Discoveries of the Past

- Great Bear Resources’ major gold discovery led to its stock going up over 56x before a $1.1-billion-dollar buyout by Kinross.7

- After Vizsla Silver’s major silver discovery its shares shot up 68% in a single day8 and have continued to steadily rise from there.

- Filo Mining’s major copper and gold discovery and ongoing expansion of the project’s mineral potential has caused the stock to rocket up by 895% from January 1, 2021 to now.9

So, what does the future hold for Tier One (TSXV:TSLV) (OTCQB:TSLVF)? Only the future will tell, but it appears to have some exciting factors working in its favor.

Why Tier One Silver Deserves Closer Inspection

When it comes to Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF), several things stand out.

For one thing, the company is sitting on high-grade surface results for silver and there are indications of copper as well.

Copper demand is expected to double by 2035 because, like silver, green energy like EVs and solar power rely on it.10

In fact, if not resolved, the copper supply shortage could completely derail the clean energy transition that the US and other governments are looking to accomplish in the coming years.

Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) exploration at Curibaya indicates the potential for a copper porphyry system beneath the high-grade silver. The property is in close proximity to some of the largest copper mines globally. In fact, Curibaya is located within a short distance of four of the largest copper producers in Peru, so the address couldn’t be better.

The bottom line is, the company’s Curibaya project is already developing into an incredible story even though it has only explored less than 20% of the Curibaya property so far.

It may be one of the reasons that some of the biggest mining players in the area have staked land around the Curibaya property and taken an interest in the project. It’s becoming clear that Tier One Silver may be onto something.

A second thing working in favor of Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF) is its management team.

Leadership at Tier One has had multiple past successes of discovering and monetizing world-class deposits.

And they’re hungry to do it again.

They’ve pulled together a technical team with a level of major mining expertise that’s rare to find in a junior company (more on that later).

Plus, they’ve continued to demonstrate their ability to raise capital in good and bad markets, with recent raises including

- C$13.45 million closed on March 2, 202111

- C$6.18 million completed on June 16, 202212

A third thing working in Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) favor is the silver marketplace. Falling mine supply – down 8.5% between 2016 and 2021 – is expected to provide long-term price support for silver.13

Tier One is trading at around 30 cents due to recent market conditions, despite having added tremendous value since its initial raise at $1.00.

The company may also be at an inflection point with several significant catalysts expected soon (more on that coming up, too).

Add both the silver supply squeeze and the impending copper deficit and you have an opportunity that could potentially elevate Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) demand amongst the investing community.

Press Releases

- Tier One Obtains Receipt for Short Form Base Shelf Prospectus

- Tier One Silver Receives Drill Permit for Additional Drilling at Curibaya Project

- Tier One Announces Filing of Preliminary Short Form Base Shelf Prospectus

- Tier One Silver Commences Work at Curibaya and Hurricane Projects in Peru

- Tier One Silver Closes C$2.82 Million Final Tranche of Private Placement

But hold on, we are not done yet. There are a lot more advantages when it comes to Tier One Silver (TSX:TSLV) (OTCQB:TSLVF):

5 More Reasons

Why Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF) Should Be Considered

1

The Global Solar Panel Market: This market is expected to have a Compound Annual Growth Rate (CAGR) of over 25% each year from now until 2028,14 and each solar panel contains 20 grams of silver, as it’s still the best conductor of electricity.15 We can expect immense silver demand from the solar sector alone!

2

Long-Term Price Support: Surging demand, falling mine output, and supply deficits are expected to provide long-term price support for silver and copper

3

Extensive High-Grade Sampled: Curibaya project surface samples returned multiple areas of +1000 g/t silver over a large 4 x 5 km area– implying a rich silver system!

4

High-Grade Drilling Results: Phase 1 results at Curibaya included 1.5 meters of 1,129 g/t silver, 1.04 g/t gold

5

Technical Team Expertise: Including a Chief Geologist formerly from Newmont and SVP of Exploration who was integral in discovering major silver deposits in Peru

Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) Exploration Assets Go Beyond the Exciting Curibaya Project

Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) President and CEO Peter Dembicki explains the potential of this project perfectly.16

Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) President and CEO Peter Dembicki explains the potential of this project perfectly.16

The project includes

- Large scale (~16,800 hectares; ~41,513 acres)

- +1000 g/t silver grades demonstrated on surface and subsurface

- Multiple structures with high-grade results and strike length yet to be tested

- Exceptional access to infrastructure: road, highway, port, airport (see map below)

The project is also located in a copper porphyry belt that hosts some of Peru’s largest porphyry deposits, including Freeport McMoRan’s Cerro Verde deposit, Southern Copper’s Cuajone and Toquepala deposits, and Anglo American’s Quellaveco deposit.17

Channel Sampling Highlights from Exploration to Date

Second Project with Exceptional Silver and Copper-Nickel-Platinum-Palladium Grades

As if Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) story wasn’t good enough already, this company also has a second project that is rapidly gaining the market’s attention.

Here’s a quick overview of Tier One Silver’s Hurricane project:

- Option for 100% ownership

- Large-scale district (~30,000 hectares; ~74,131 acres)

- Project and region within Peru are highly underexplored

- Exceptional copper, nickel, platinum, palladium, and cobalt grades from historical drill results

- Excellent infrastructure: road access, close to power lines; 66 km/41 miles to nearby city

- Social permit acquired for 2 high priority targets

But that information doesn’t tell the whole story, historical work at the site, which was completed by a former operator from 2009 to 2010, included an initial drill campaign that produced: 14 meters of 2.59% copper, 0.62% nickel, 311 g/t cobalt, 0.3 g/t platinum and 0.55 g/t palladium.18

These results were nothing short of spectacular, and put the Hurricane project on the map as the only known copper nickel exploration play in Peru!

And that’s not all; first pass reconnaissance rock sampling by the company found 5 mineralized vein corridors and exceptional silver grades, including:

- 6 meters of 375.1 g/t silver equivalent (AgEq) (239 g/t Ag, 1.21% Cu, 0.34% Pb, 0.15% Zn)

- 4 meters of 441.7 g/t AgEq (234.7 g/t Ag, 1.98% Cu, 0.13% Pb, 0.29% Zn)

1 meter of 860.4 g/t AgEq (605 g/t Ag, 0.26% Cu, 5.79% Pb, 0.21% Zn)

High-Grade Silver Results from Surface Exploration

Work in the Permitted Zone

This early-stage project only adds to Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) overall valuation and potential upside.

The company also has solid plans to advance these two projects and continue increasing shareholder value and confidence. Its plans include:

These efforts have the potential to create lots of news that could positively impact the stock.

There is also the fact that Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) stock price shows a strong correlation with the silver price.

Why is this important?

Because major financial institutions are calling for a +20% rally in the price of silver by the end of this year.19

Bank of America still sees the gold price hitting record highs and the silver price pushing to $30.20

Silver is the ‘perfect commodity’ as it carries all the known qualities of investing in gold, but holds all the use cases of copper.

Put it all together and the next few months could be when Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) stock elevates to a whole new level.

As We Have Seen, Major Discoveries Often Create Big Wins

Take a junior mining stock that still has lots of upside potential, then add in the catalyst of a major mineral discovery, and the potential to skyrocket the stock’s price can be astounding.

Great Bear Resources picked up its Red Lake Dixie Project from Newmont Mining in 2017. The company made multiple, large, high-grade gold discoveries near the surface. Without even releasing a resource calculation,21 the stock went up over 56x before Kinross bought the company out for a cool $1.1 billion.22

Great Bear Resources picked up its Red Lake Dixie Project from Newmont Mining in 2017. The company made multiple, large, high-grade gold discoveries near the surface. Without even releasing a resource calculation,21 the stock went up over 56x before Kinross bought the company out for a cool $1.1 billion.22

Vizsla Silver made a major silver discovery in Mexico in mid-2020, including 8.2 meters at 1,544 g/t AgEq and 2 meters at 3,348 g/t Ag-eq.23 The company’s shares shot up 68% in one day and kept rising. A little over a month later it raised $30M and billionaire Eric Sprott took a $10M stake.24

Vizsla Silver made a major silver discovery in Mexico in mid-2020, including 8.2 meters at 1,544 g/t AgEq and 2 meters at 3,348 g/t Ag-eq.23 The company’s shares shot up 68% in one day and kept rising. A little over a month later it raised $30M and billionaire Eric Sprott took a $10M stake.24

Filo Mining hit copper and gold big time in 2021. By January 2022, the company reported one of the top silver intercepts globally in the past decade.25 The project now has an Indicated Resource of 147 million ounces of silver.26 The stock responded by shooting up by 895% from January 1, 2021 to now.

Filo Mining hit copper and gold big time in 2021. By January 2022, the company reported one of the top silver intercepts globally in the past decade.25 The project now has an Indicated Resource of 147 million ounces of silver.26 The stock responded by shooting up by 895% from January 1, 2021 to now.

The Curibaya and Hurricane projects give Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF) the potential to realize similar gains.

Here is a closer look at what could happen with Tier One Silver:

Remember, This Company is Also Led by Major Industry Experts with Strong Track Records of Success

The company’s Chair, Ivan Bebek, has over 20 years of experience in financing, foreign negotiations and acquisitions in the mineral exploration industry. He has an in-depth understanding of capital markets. He’s also been behind big discoveries and big buyouts.

He was the President, CEO and co-founder of Cayden Resources, which sold to Agnico Eagle Mines for $205M in 201427 during possibly one of the worst mining markets in recent history for a 5x return.

Prior to Cayden, Bebek also co-founded Keegan Resources in West Africa and had a huge 18x return for shareholders as an exit.

Stellar track records like that attract investors and other industry experts. Just look at what Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) President and CEO Peter Dembicki, said:

“I wouldn’t have left a successful career after 10 years at the largest investment firm in the country to go with a mediocre project and to go with a mediocre team.”28

Tier One Silver’s management team includes:

Peter Dembicki President, CEO and Director

Peter Dembicki President, CEO and Director

- 10+ years corporate finance and wealth management experience

- Former member of Canaccord Genuity; structured and oversaw multi-million dollar private, public and bought-deal financings in mining and natural resource sectors

Michael Henrichsen Chief Geologist

Michael Henrichsen Chief Geologist

- Former global structural geologist at Newmont; instrumental in significantly increasing reserves and resources base in Ghana’s Ahafo district

- Worked extensively at other major gold camps in South America, the Carlin Trend, Guinea and Canada

Christian Rios SVP, Exploration

Christian Rios SVP, Exploration

- Professional geologist (P.Geo.)

- Former VP of Exploration at Bear Creek Mining; directly involved in discovery of the world-class Santa Ana and Corani silver-lead-zinc deposits in Peru

- 20+ years experience in exploration, mining development and operations, specializing in Peru

Ivan Bebek Chai

Ivan Bebek Chai

- 20+ years experience in financing, foreign negotiations and acquisitions in the mineral exploration industry

- Track record of driving success through understanding of capital markets and ability to position, structure and finance companies

- Former President, CEO and co-founder of Cayden Resources (sold to Agnico Eagle Mines for $205M)

Co-founder of Keegan Resources (now Galiano Gold)

One More Thing Working in Tier One Silver’s Favor is “Location”

You only need to know 7 things to understand why Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) Peru-based projects are in an ideal mining jurisdiction:

- Continuous economic and political support since the early 1990s

- One of Latin America’s fastest-growing economies

- Mining is Peru’s dominant economic sector29

- World’s largest reserves of silver30

- World’s second largest producer of silver

- World’s second largest producer of copper31

- World’s 6th largest producer of gold32

“Peru is a global leader in the mining industry,

which makes it a natural choice for international investors.”

– EY: Peru’s Mining & Metals Investment Guide 2022/202333

When you add up Tier One Silver’s exploration assets, leadership team, and location in one of the world’s top mining countries, you get a company that may be seriously undervalued at the moment and deserving of closer inspection.

With silver expected to rise soon, we recommend doing your due diligence on Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF). As we mentioned, this is a company that historically has followed the price of silver. That means there is the potential for big gains ahead.

To help you start your research, here is a recap of the main advantages we believe Tier One Silver has.

RECAP: 7 Reasons

Tier One Silver (TSXV:TSLV) (OTCQB:TSLVF) Is a Junior Mining Play Worth Watching

1

Extensive High-Grade Sampled Curibaya project surface samples returned +1000g/t Ag over a 4 x 5 km area

2

High-Grade Drilling Results: Phase 1 results at Curibaya included 1.5 meters of 1,213.7 g/t silver equivalent

3

Potential for copper deposit below the silver system at Curibaya

4

Second High Potential Project: The Hurricane project has both high-grade silver and copper and nickel mineralized systems; further exploration is underway

5

Track Record of Success: Leadership at the company has navigated big discoveries and buyouts and has successfully raised capital in good and bad markets

6

Technical Team Expertise: Including a Chief Geologist formerly from Newmont and SVP of Exploration who was integral in discovering major silver deposits in Peru

7

Large Growth Potential: Trading near all-time lows despite lots of added value since initial raise, with multiple catalysts in the pipeline

Now that you know a bit about Tier One Silver’s (TSXV:TSLV) (OTCQB:TSLVF) potential, stay tuned as this company’s story develops. Click below to sign up for the company’s newsletter to stay current on Tier One’s latest news and results.

The second half of 2022 could be big for Tier One as it advances both of its projects.