It’ll come as no surprise that healthcare has changed – after the last couple of years, how could it not?

But no one could have predicted the explosive growth of telemedicine.

Investments in digital health reached an all-time high of $57.2 billion in 2021.1

And it’s not about to stop there.

The global telehealth market is set to reach $636.38 billion by 2028, a CAGR of 32.1%!2

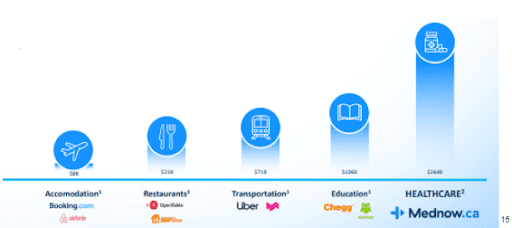

Tech enabled services are growing faster than ever, including for healthcare. People want to use their tech to order food, transportation, and essential services like telehealth.

Seriously, telehealth is booming.

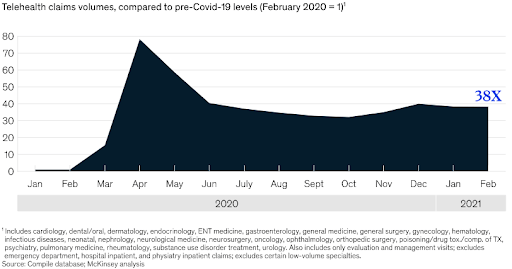

According to McKinsey, telehealth utilization is 38X higher than pre-pandemic levels, and looks like it’s here to stay.

3

3

And there are few companies in the telehealth space like Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF).

Mednow has made it so you basically never have to step into a pharmacy or doctors office again. The company has a unique business model and growing revenues.

Revenue growth for the company’s pharmacy solution, GoodRx, has been stellar, with Q2 2021 revenue hitting $176.6 million, 43% growth YoY!

This is also an industry that has seen big deals in the past couple of years, like Amazon’s huge US$753 million acquisition of Pillpack in 2018, jumping into the online pharmacy space.4

With telemedicine adoption rates soaring, the company is seeking to tap into an essential, profitable, and rapidly growing market. Mednow has the potential to grow with the industry and provide exceptional service to clientele.

It’s no surprise that management believes the company could gain the attention from some of the biggest pharmacy and retail companies in the world.

Mednow’s (TSXV:MNOW) (OTCQB:MDNWF) market cap as of February 22, 2022 was C$23.4 million, a bargain compared to a C$130 million valuation following its March 5, 2021 IPO, which raised C$37 million at C$6.75 per share!5

Mednow is expected to grow its YoY revenue by over 2,400% in calendar 2022, compared to 2021.

Mednow (TSXV:MNOW) (OTCQB:MDNWF) is just getting started, and here are:

6 Reasons

Why Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) is a leading company at a key time for the telehealth industry

1

Innovative business model: Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) has a different business model than other companies in the market, which represents a huge advantage that stands out and generates income. Its business plan has allowed the company to increase its revenue and footprint while lowering the cost of acquiring a patient, which is beneficial to the company.

2

Growing revenues: revenue increased for the first quarter of 2022 by more than 4.5 times from the previous quarter and more than 13.5 times from the previous year . Along with the publication of their financial results, they also announced an operational update, including their recent acquisitions of Liver Care Canada Inc., London Pharmacare, and Infusicare.6

3

A pioneer in providing new and modern telemedicine solutions: The company has taken the initiative to provide new, more modern and efficient solutions, which Forbes pointed out as an important factor for telemedicine. Such is the case of Medvisit, acquired by Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) whose objective is to provide home medical services for the treatment of acute and episodic injuries and illnesses. As well as providing support for mental health through Health Check offered by Life Support Mental Health Inc. a company in which Mednow Inc. has a sizeable stake.7

4

Expanding: In addition to the strategic investments made in the Canadian market, Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) is invested in a company in the US telehealth market. The US telehealth market was estimated to be worth $144.38 billion in 2020 and continues to grow steadily.8

5

Growing in the Canadian market: In Toronto, the company has received approval from the Ontario College of Pharmacists at its Eastern Avenue location and expects to soon begin operations there. In addition the company has plans to expand into Alberta, Manitoba and Quebec to make a large national presence.

6

Improves its specialty pharmacy services: The company has acquired Infusicare Canada Inc., whose wholly-owned subsidiary is a specialty pharmacy in London, Ontario. With the partnership, Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) can quickly enter the specialty pharmacy market. Infusicare had approximately C$9.3 million in revenue and approximately C$400,000 in gross profit, boosting the company’s revenue. 9

Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) Receives 2022 Best Workplace AwardTM – Start-ups10

Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) announced that it has been recognized as a 2022 Best WorkplaceTM – Start-ups. To be listed the company must have a certified great place to work, identify as a new business, and have been in the industry for a minimum of 10 years.

recognized as a 2022 Best WorkplaceTM – Start-ups. To be listed the company must have a certified great place to work, identify as a new business, and have been in the industry for a minimum of 10 years.

Mednow Inc. believes that it has a strong ability to attract, retain and harness talent for higher quality ideas and quick and effective implementation of those ideas.

Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) partners with PACE Consulting Benefits and Pensions Ltd. and Pace Consulting MGA Services Inc.

Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) also recently announced its partnership with PACE Consulting Benefits and Pensions Ltd. and PACE Consulting MGA Services Inc.

partnership with PACE Consulting Benefits and Pensions Ltd. and PACE Consulting MGA Services Inc.

These partnerships should enable Mednow to connect with employers that seek to offer an improved standard of benefits to its employees, improve employee productivity and manage the costs associated with benefit plans through a digital-first, patient-centric healthcare platform.

These deals show Mednow continues to scoop up business in the critical employee benefits vertical.

Want more information on Mednow Inc. (TSXV:MNOW) (OTCQB:MDNWF) and their growing share of the telehealth sector? Click here.