Despite the skyrocketing growth occurring in the cryptocurrency markets there are still many investors who are hesitant to put their money in.

The big reason? The lack of regulation that currently exists in the marketplace. Just look at a few recent cryptocurrency-related headlines:

- “Cryptocurrency Investors Risk Losing All Their Money, UK’s FCA Warns”

- “Chaos and Hackers Stalk Investors on Cryptocurrency Exchanges”

- “The Biggest Risks of Investing in Bitcoin”

In other words, investors’ fears would appear to be justified … but what if there was a company that was working with the SEC instead of against it?

And what if that company actually had the world’s first SEC-registered digital security?

Not only that, but what if at the closing of its IPO in April of last year, this company had already garnered $83.6 million in gross proceeds from over 7,250 retail and institutional investors with 92.9 million Security Tokens sold at a price of $0.90?1

Would you be interested in learning more about a company that is quickly bringing regulation and potential safe haven investing to the unregulated cryptocurrency marketplace?

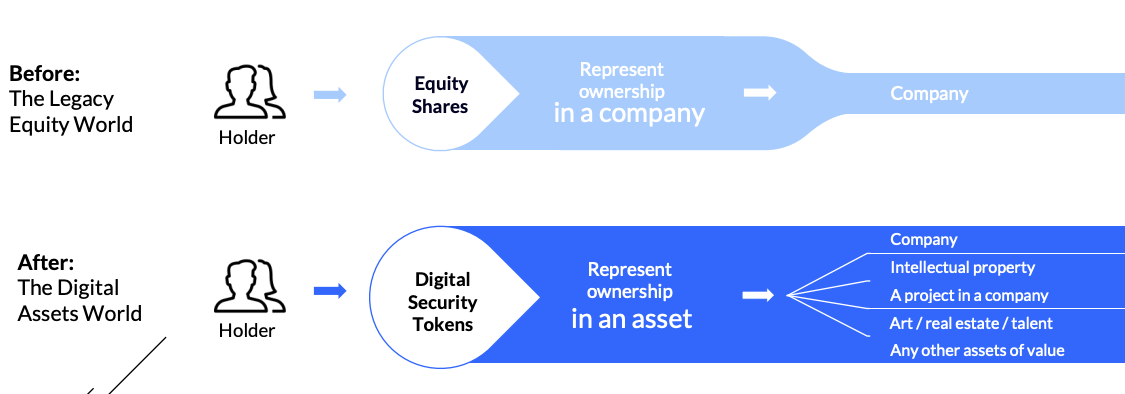

If so, keep reading, because we are going to identify that company shortly and also tell you how it is creating a ‘Capital Markets 2.0’ – a new marketplace where digital securities are replacing the role of equity in the markets for capital raising and trading.

Still here? Fantastic!

So first things first, let’s reveal the innovative company that is quickly reshaping financial markets:

Introducing INX (NEO:INXD)

INX (NEO:INXD) was founded back in 2017 with three primary objectives:

- To launch an unprecedented blockchain IPO under a prospectus filed with the SEC

- To develop regulated trading platforms for all blockchain based assets.

- To raise $117 million to execute its vision and business plan.

Now, at the beginning of 2022, it has accomplished all of these objectives and in the case of #3 even exceeded the original goal – raising over $125 million in proceeds resulting from the successful sale of close to 100 million INX tokens and a CA$39.6 million private placement.2

Well-Funded With Innovative Technology, INX is Now Quickly Opening the Cryptocurrency/Digital Security

Market to the Entire Investment Community!

This is important because a healthy financial marketplace requires both retail and institutional investors.

Retail investors bring liquidity and attention to the platform via frequent trading; while institutions anchor the capital pool, providing longer term incentives for first-tier market makers.

INX (NEO:INXD) became the first platform to enable both institutional and retail regulated trading of digital assets 24/7/365 – and it had US regulatory compliance in mind from the beginning.

That’s an enticing combination for investors looking to get involved in the crypto marketplace while avoiding the market’s notorious uncertainty and risk.

INX (NEO:INXD) offers investors exposure to:

- The INX Digital Securities Trading Platform – Allowing enterprises and early stage companies to perform regulated and safe capital raising through the issuance of securities instead of legacy equity offerings. In addition, the platform also allows for fast digital security trading by retail customers.

- The INX Cryptocurrencies Trading Platform – Allowing listing and trading of digital currencies with full regulatory compliance, fair trading policies, security protocols and privacy procedures, supporting the trading of various digital assets, not limited to one or two blockchains

- The INX Token – this is a digital security, which means it is a programmable security offering higher flexibility and innovative functionality of asset listings, trading and governance. The token actually has both security and utility characteristics. As a security, token holders are eligible to receive an annual 40% distribution of any positive cumulative net operating cash flow. As a utility, the tokens should be able to be used to pay for trading fees on the crypto trading platform.

INX (NEO:INXD) is confident more traders, investors and organizations will be drawn into the world of cryptocurrency and blockchain as they learn about the ease of their trading platforms and their token that is rapidly increasing in value (up 298% since introduction).3

All of this makes INX a potentially exciting opportunity for forward-looking investors. Because at the exact time when investors are rapidly losing faith in crypto …

Lawsuits were recently filed against Binance, BitMex, Tron Foundation and other major crypto companies alleging they sold unregistered securities! The lawsuits allege that the firms bilked investors by selling unlawful securities in the form of digital tokens.4

… The first company to get FINRA (Financial Industry Regulatory Authority) clearance for trading digital securities 24/7/365 has appeared on the scene.

The Bottom Line …

The growth in the cryptocurrency/blockchain market has been quick and massive. Of course, that kind of growth attracted companies who were willing to cut corners in an attempt to gain a share of the large amount of profits being generated.

But now those companies are beginning to pay the price …

And a company like INX (NEO:INXD), that did things the right way, is set to take their place.

INX CBO Douglas Borthwick recently told Forkast.News that the SEC approval process took three years because INX and the SEC were working to define terms that never existed in any prospectus.

“What is Ethereum? A smart contract? No one had ever expressed them or defined them in a prospectus before,” Borthwick told Forkast.5

Now, with that process complete, the INX token is defined as an “ERC-1404 smart contract” – indeed, it is a registered digital security on the Ethereum blockchain.

INX took its time and did it right … and now it is now positioned to reap the benefits of that hard work.

The good news is investors who act fast could also potentially benefit from the company’s hard work. So to learn much more about INX, its platform, its token and how it is creating a ‘Capital Markets 2.0’, click on the link below.

Yes, I want to learn much more about INX (NEO:INXD)!