Do you want to get a degree in your favorite subject, but you can’t because of the cost of tuition? You are not by yourself. Despite a positive jobs report, there are more than 45 million borrowers in the US with student loan debt that exceeds $1.7 trillion. An undergraduate averages $27,000 in debt due to high-interest rates.

The cost of earning a college degree is high, with tuition often making up the majority of the expense. Thankfully, a lot of educational institutions now provide deferred tuition charge options, making it simpler for you to meet your academic objectives.

Colleges can make it easier for more people to go to school by making upfront payments less expensive or delaying them. This makes it simple for many young people to select courses that they are interested in without having to worry about debt from student loans.

Unlike a four-year college program, many of these opportunities don’t cost anything unless you get a job within a certain amount of time and at a certain wage. Students are then able to make the most of this chance and improve their academic destinies.

Lambda College

The Lambda School’s programs include:

-

- a six-month computer science course that covers important programming languages;

- a seven-month data science course that trains students for a machine learning-specific job

Every class is taught online.

The Lambda School does not charge fees. Instead, they mandate that students pay for their education after they land a job that offers an annual salary of $50,000. Once students land a job that satisfies these minimal pay requirements, they are required to repay 17% of their pay over the course of two years (with a $30,000 payment cap).

If students can’t find jobs that pay enough to meet these requirements, they don’t have to pay anything. Additionally, individuals have the option to halt their payout for that month if they quit their employment or if their monthly payment falls below $4,166.66.

App School

Students can learn the skills they need to become software developers by taking a 12-week course at App Academy. They can sign up for a 24-week online course or attend lectures in either New York or San Francisco.

Students who attend classes in New York or San Francisco can put off paying until after they graduate. Once they reach a total pay of $50,000, a portion of their first-year pay goes to the institute. If students don’t land a job within a year of graduating, App Academy won’t charge them any more fees.

Columbia College

Columbia College by assisting them in paying for their studies without accruing student loan debt, Columbia University helps students. There are numerous need-based and need-blind apps available. These financial aids make sure that students from all socioeconomic classes benefit the most from attending Columbia University.

Additionally, the university grants discounts to students whose estimated family income is under $60,000. Each year, Columbia invests more than $150 million in grants and scholarships.

Thinkful

In as short as five months, Thinkful’s full-time online school teaches and prepares students to become software engineers. Monthly night and weekend programs are some more choices. Additionally, students have access to individualized mentoring from a personal career coach and a subject-matter authority.

Till they can earn more than $40,000 annually, students are not required to pay any tuition. They are then required to repay 15% of their salary over the following three years. Students may halt their payments for 24 months if they change employment and their income falls below $40,000.

University of the People

The University of the People (UoPeople) offers bachelor’s degree programs in business administration, health science, and computer science that take either two or four years to finish. A recent online Master of Education (M.Ed.) program from UoPeople is tuition-free.

There are no tuition fees or teaching or instruction costs at UoPeople. For each course taken, the school only charges an evaluation fee and an application fee. The University of the People (UoPeople) offers scholarships designed to aid and support students who can’t pay the application and assessment fees and are given help with their school work.

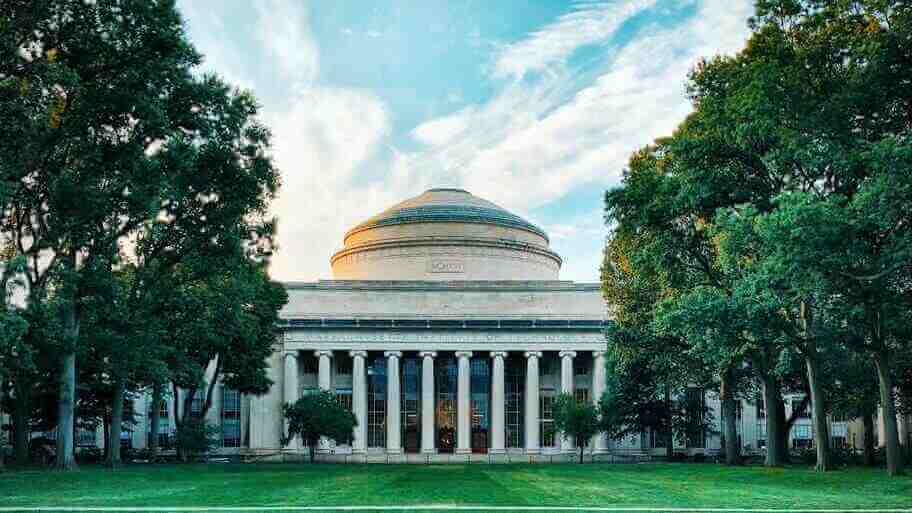

MIT

MIT supports both domestic and foreign undergraduate students in obtaining the required education. The average cost for undergraduate students who receive financial aid was, in fact, $21,917 in the 2019–2020 academic year. The institute makes sure that students who come from families with annual incomes under $90,000 can get scholarship funds so they can attend MIT tuition-free.

MIT also provides OpenCourseWare (OCW), which provides students with free course materials online. OCW is a website that publishes all of MIT’s course materials. Making more resources available and easy to get to for everyone, gives students more power and helps them get better.

Conclusion

When they are just starting their careers, students shouldn’t have to worry about crushing debt. With a little research, you might be able to find college programs that don’t cost you anything. This will let you finish the schooling you need to start a successful career without having to keep making payments.

Free courses are a good way to close the gaps in the system because they help students from lower socioeconomic backgrounds reach their academic goals. Grad School Hub has a list of the top 30 master’s programs with their tuition costs listed next to them. This makes it easy to find cheaper options if you’re looking for them.

Featured Image: Freepik