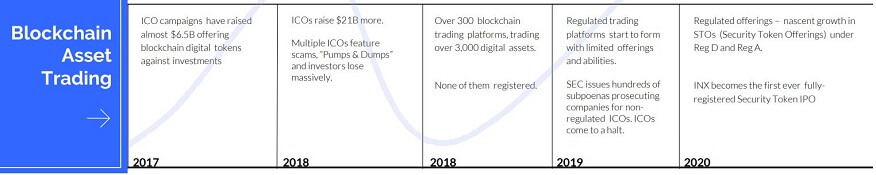

It’s only been a few years since digital currencies have gone mainstream.

They are now one of the hottest investments, and trading has skyrocketed in volume.

It’s been said that weeds grow first on fertile soil before grass takes hold.

And that’s exactly what’s happening right now.

Many digital currency platforms are plagued with weed-like scams, terrible security, and unregulated digital assets.

For decades, the SEC has operated as the financial sheriff within the US, protecting hundreds of millions of investors.

This is why it started to crackdown on digital currencies and unregulated platforms in 2017 and over 11 companies are now facing lawsuits,¹including Binance, one of the biggest digital asset exchanges.²

While some may feel US regulators are overly strict, it should come as no surprise given what happened with the 2018 Coin Bubble.³

In a sense, that bubble was like the Wild West days of the Internet, when highly-speculative and non-viable business models “grew like weeds,” leading to what we now know as the Dot-com Bubble.

Behold the phoenix! There’s an exciting new company that has emerged from the ashes of irregulation, and it’s called INX (NEO:INXD).

It was among the first trading platforms to get FINRA approval to become a digital asset alternative trading system (ATS) AND was the world’s first SEC-registered digital security IPO on the blockchain.

Why People Call INX (NEO:INXD)

The NASDAQ 2.0!

Many industry experts note that:

- INX Securities is among the first trading platforms to get FINRA approval to enable trading of digital securities.

- It’s the first to open up 24/7/365 digital asset trading to worldwide institutions and retail, representing a $40 TRILLION market.⁴

- INX Securities, LLC parent entity, INX Limited, was also the world’s first SEC-registered digital security IPO issuer on the blockchain, raising close to $85 million from over 7,250 retail AND institutional investors and now trading on the INX Securities ATS.

Clearly, INX is a company that takes financial regulation seriously and provides a fully regulated platform that will give investors confidence and trust.

…which is why it’s so important you hear about this right now.

History Could Be About To Repeat

Itself For The “Digital Assets Evolution”

Regulators are sifting through which companies are here to stay, and INX (NEO:INXD) is among the first of them.

But perhaps, INX (NEO:INXD) already has an unfair advantage to start with, given its team comprises an ex-Vice Chairman of NASDAQ (yes, THAT NASDAQ) and ex-CEO of Toronto Stock Exchange, among other financial superstars you’ll be blown away by as you read.

Together, they have successfully launched a digital asset trading ecosystem for listing and trading digital currencies, private and public digital securities, and digital asset derivatives will be added at a later stage.

Together, they have successfully launched a digital asset trading ecosystem for listing and trading digital currencies, private and public digital securities, and digital asset derivatives will be added at a later stage.

As an owner/operator of digital asset trading platforms, the company generates revenues from digital currency trading, digital security trading, capital raising and listing fees.

Simply put, the more users open accounts at INX’s (NEO:INXD) platform to do these activities, the more revenue it generates.

The fact that the company can offer a “nose-to-tail” solution for all issuers who want to issue a digital security, raise capital through a primary offering and then list their digital security on INX Securities ATS is a great advantage that the company will leverage in the short and long term.

But an even more important foundation is that the people behind it aren’t just regular business owners; they came from leading financial institutions across Wall Street.

That’s why people call INX (NEO:INXD) the NASDAQ 2.0,⁵ given the scale it is bringing into this $40 TRILLION market opportunity.⁶

Why “Smart Money” Could Continue Pouring Into INX

Reason #1 – INX (NEO:INXD) Has Entered

The Market at the Right Time As One of the World’s First Regulated Digital Assets Trading Platforms

While the parallel between the Coin Bubble and the Dot-com Bubble is astounding, it is even more so when you compare the historical development of digital assets to traditional stock trading.

As you can see in digital asset trading, we’re past the “No Regulation” phase where the Coin Bubble took place – just like equity trading survived one of the first crashes in 1711.

Plus, as we discussed, regulators have entered the digital assets space – much like when NYSE and NASDAQ became regulated stock exchanges in the age of public corporate finance.

And now…

We’re Entering The “Mass Adoption”

For Digital Assets Phase

…as INX (NEO:INXD) became one of the first companies to receive regulatory approval to trade digital securities.

Despite the fact that other platforms have succeeded in the unregulated market, their survival is suspect because most of them are still stuck in the “No Regulation” or “Ban” phase.

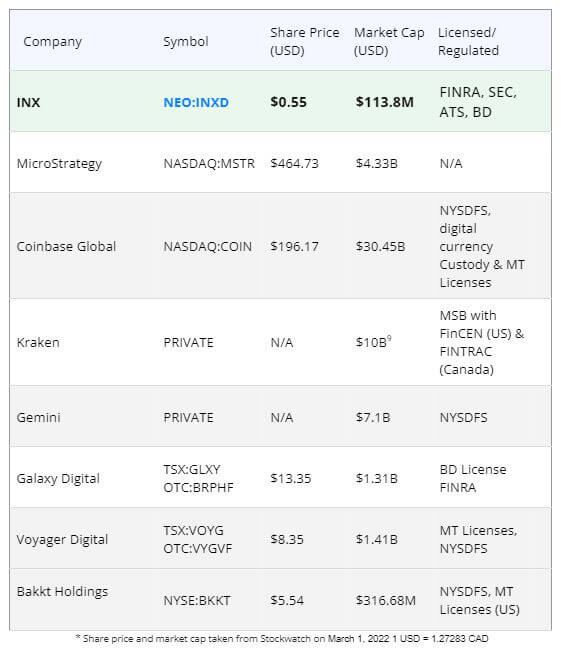

Look at the stock chart below to see how prices compare:

What you’re seeing is likely how undervalued INX (NEO:INXD) is right now, and that it is well-poised to make a leapfrog over these other companies.

Reason #2 – INX (NEO:INXD) Built A Proprietary Tech Stack That’s Developed For Digital Assets

When INX (NEO:INXD) was introduced, people were stunned by the new standard it set, with experts believing their competitors must follow to survive…

There are still many investors in the world who are nervous about digital currencies and digital securities, and rightfully so because of the horror stories that have tainted this industry.

According to BBC News, North Korean hackers have stolen almost $400 million worth of digital assets in at least seven cybersecurity attacks in 2021.15

And you don’t need to look too far to spot another tragedy.

Bitmart, a renowned trading platform, had nearly $200 million in digital assets stolen!16

Evidently, branding as “the most trusted cryptocurrency trading platform” doesn’t mean much in terms of security.17

And these shocking incidents are all over the news because many of their tech protocols are licensed or bought from unsuitable third parties.

This is why…

INX (NEO:INXD) Invested Two Years

Building Its Proprietary Tech Stack From Scratch

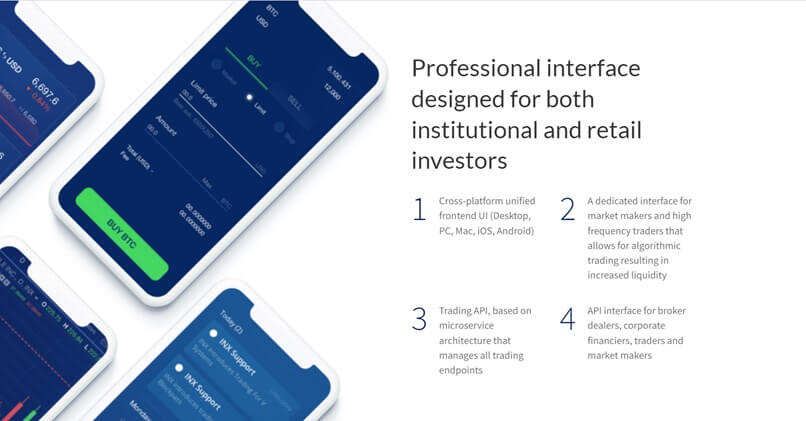

But apart from enhanced security, INX (NEO:INXD) has achieved an even higher standard for the user experience.

It offers powerful technical analysis tools, as well as a professional, sleek user interface that appeals to both retail and professional traders…

… all while providing the capacity for high-frequency trading and instant asset settlement (no more taking days to clear transactions).

Reason #3 – INX (NEO:INXD) Is The First Legal Platform To Trade Digital Securities 24/7/365

INX (NEO:INXD) is a front runner in regulated digital securities.

These are digital representations of equity, cashflows and other securities that settle and trade on the blockchain.

They trade 24/7/365 and can offer fractional ownership of equities and cash flows.

And this is huge because most of the world lives outside of US time zones! With 24/7/365 trading, global investors can trade on their own terms, when they want to!

But with INX (NEO:INXD) pioneering the first-ever legal digital security trading…

Many Industry Experts Expect

A Surge In International Investing!

… leading to increased liquidity across the equity market.

And, when you consider the benefits of trading securities on the blockchain…

- Improved security

- Transparency

- Faster settlement of transactions

Plus, unlike traditional equity ownership, in some cases owning digital securities can translate into partial claims over the company’s assets! – It’s obvious why investors are so excited to use this platform.

And this could attract an avalanche of companies to list their securities on INX (NEO:INXD).

And this could attract an avalanche of companies to list their securities on INX (NEO:INXD).

What could this mean for you as an investor?

It is positioned to generate unprecedented revenue from digital currency trading, digital security trading and listing fees.

With this confidence, INX (NEO:INXD) offered every token holder 40% of positive cumulative net operating cash flow.

Not surprisingly, over 7,250+ retail and institutional investors bought the tokens, which could signal a much bigger stock IPO.

Reason #4 – INX (NEO:INXD) The

New Apex Leader In The $40 TRILLION Market18

INX (NEO:INXD) is taking advantage of a $40 trillion19 market when you include retail investors and large institutions, both are crucial for healthy financial markets.

Retail investors bring liquidity and attention to the platform via frequent trading, while institutions anchor the capital pool to provide long-term incentives for first-tier market makers.

Simply put, INX (NEO:INXD) is one of the first trading platforms to pave the way for both institutional and retail trading of digital assets with compliance in mind from day one.

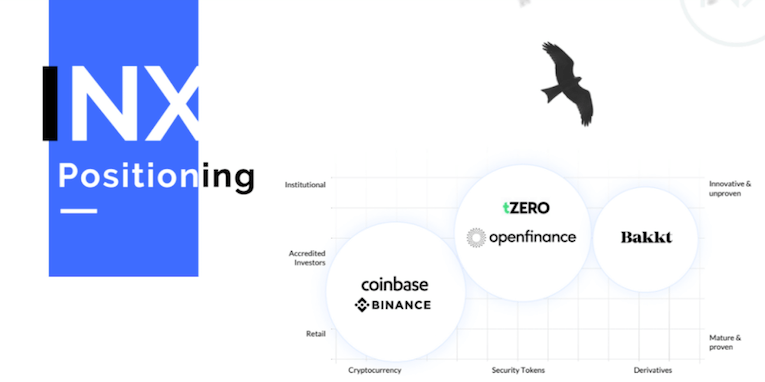

An easy way to understand what’s at stake is to see it from a market positioning perspective:

What you’re seeing is the landscape of INX’s (NEO:INXD) “competition,” where digital asset exchanges claim specific market niches.

And because some of them operate in their own little corners, especially those that appeal only to retail “digital currency speculators,” it took a while before the regulatory spotlight found them.

But take a look at this:

INX (NEO:INXD) is well-positioned to significantly outperform the “early starters” and transform the entire digital asset landscape.

Press Releases

- INX Announces Agreement to Facilitate a Digital Security Token Offering for Trucpal a blockchain-based SaaS Platform Through the INX Platform

- INX Announces New Listing On The INX Securities Trading Platform: The Millennium Sapphire Token (MSTO)

- INX and SICPA Sign a Groundbreaking Memorandum of Understanding To Establish a Joint Venture to Develop An Innovative Central Bank Digital Currency Ecosystem To Support Monetary Sovereignty

- The Global DCA Welcomes INX As A Member Ahead Of The CryptoConnection 2022 Conference

- The INX Digital Company Names Renata Szkoda as Chief Financial Officer

Reason #5 – INX (NEO:INXD) Has

Trading Relationships With Many Financial Juggernauts,

Including Wall Street’s Top Guns

Experience has shown you can evaluate a company based on the alliances it forms.

That’s why INX (NEO:INXD) has acquired with ILS Brokers Ltd.,20 an inter dealer-broker with over 50+ Tier 1 and Tier 2 global bank relationships, including:

ILS Brokers already generates more than…

“Over US$95 Billion Transactional Volume Annually”²¹

… which could help accelerate INX’s growth.

But INX isn’t limited to joining forces with just one industry powerhouse.

It has also acquired Openfinance Securities,²² now called INX Securities.

Openfinance Securities is a FINRA-registered broker-dealer that offers access to liquidity and investment opportunities in up to $40 trillion²³ in alternative public and private assets to retail and institutional investors.

All of this, and INX is only getting started!

Reason #6 – INX (NEO:INXD) Redefines What It Means To Have A Truly Exceptional Team

Among the team of leaders are the…

- Ex-Vice Chairman of NASDAQ

- Ex-CEO of Toronto Stock Exchange

- Ex-CEO of TD Ameritrade

… and former executives from…

- Morgan Stanley

- Merrill Lynch

- HSBC Brokerage USA

- TP-ICAP

- Standard Chartered

- GE Capital

- Societe Generale

- eToro

- American Express

Besides deep experience in the traditional capital market, there are top cyber specialists, blockchain experts, and key opinion leaders and insiders in critical positions.

When was the last time you saw a company with an executive team like this?

With such a robust executive management team, INX (NEO:INXD) is poised to continue its growth.

RECAP: 6 Reasons

Investors May Want To Take a Closer Look At INX (NEO:INXD)

1

INX (NEO:INXD) opens the digital asset market to everyone, representing a $40 TRILLION market opportunity²⁴ (most new industries top out at billions; this one is in the trillions!)

2

INX (NEO:INXD)’s world’s first SEC-registered digital security IPO on the blockchain that already raised over $83 million from 7250+ retail and institutional investors

3

INX (NEO:INXD) was among the first trading platforms to obtain FINRA clearance to facilitate the trading of digital securities

4

Its superstar team members include ex-Vice Chairman of NASDAQ, ex-CEO of TSX, and ex-CEO of TD Ameritrade, along with others from Wall Street stalwarts like Merill Lynch and Morgan Stanley, just to name a few.

5

It follows a similar development of the equity trading assets from inception to mass adoption (history could be about to repeat itself, only perhaps bigger this time).

6

INX (NEO:INXD) learned from competitors that failed in digital asset securities by building their proprietary tech stack from scratch with enhanced security (spending two years on this alone)

Shy DatikaCo-founder & CEO

Shy DatikaCo-founder & CEO Douglas BorthwickChief Business Officer

Douglas BorthwickChief Business Officer Itai AvneriChief Operations Officer

Itai AvneriChief Operations Officer David WeildChairman Board Member, ex-NASDAQ

David WeildChairman Board Member, ex-NASDAQ Jonathan AzeroualVP Blockchain Asset Strategy

Jonathan AzeroualVP Blockchain Asset Strategy Alan SilbertCEO, North America

Alan SilbertCEO, North America Paz DiamantChief Technology Officer

Paz DiamantChief Technology Officer